Union Budget 2017: An international perspective

Biz@India

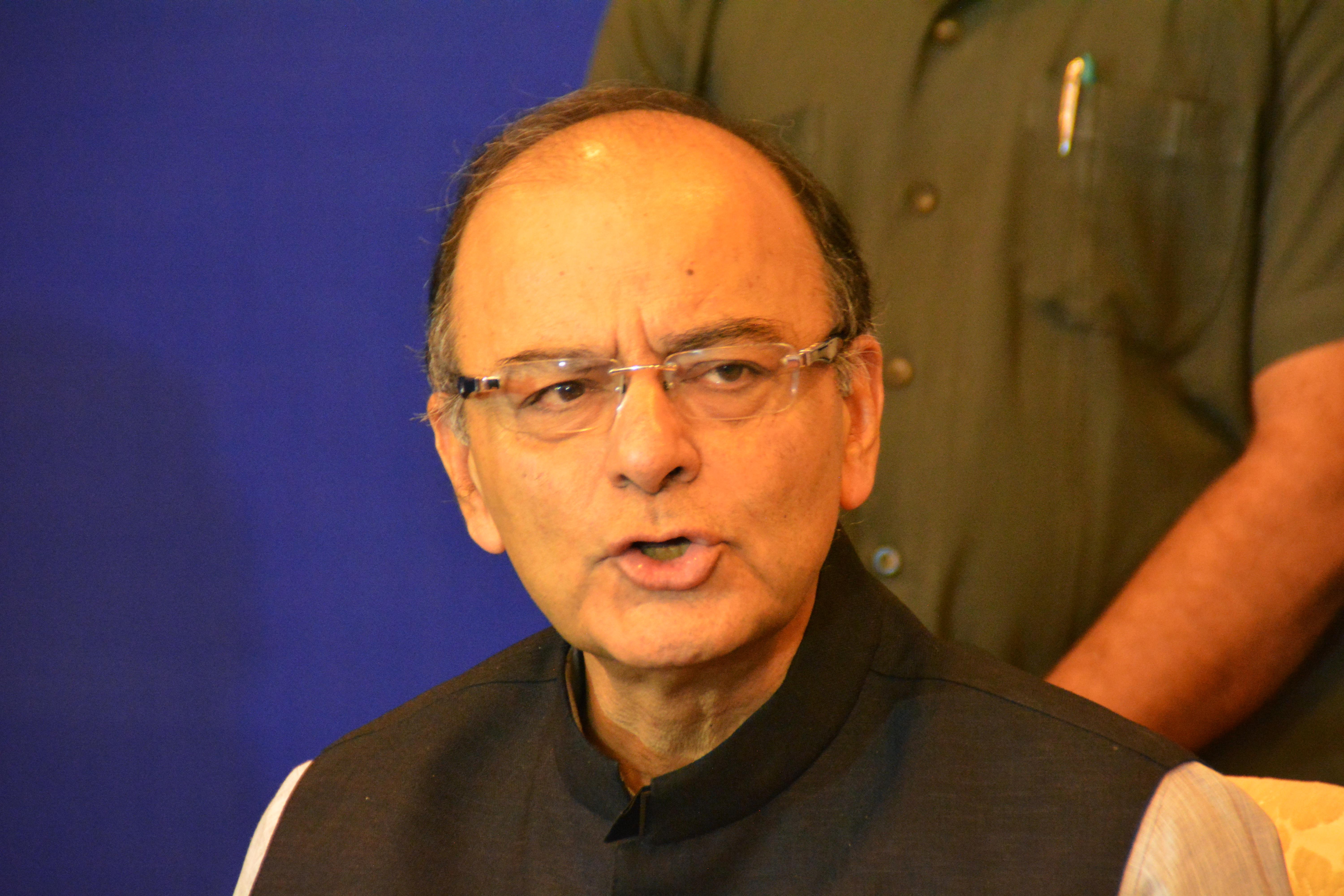

Presenting India’s Union Budget 2017, Finance Minister Arun Jaitley has made a number of announcements on Wednesday that need to be understood in a broader global economic context, which could well impact those good intentions, especially since demonetisation has taken a toll on India’s immediate growth prospects.

India’s official Economic Survey for 2016-17, published a day before the Union Budget 2017 presentation, did not look bright and drew a very constricted context for the fiscal year 2017-2018, beginning April 1. The expected growth rate, after a likely 7.1 pc for 2016-2017, shows that the economy is slowly recovering from the negative medium-term impact of the demonetisation initiated on November 8 last year by the Modi government. But this wide band of expected growth – between 6.75-7.5 pc – also shows that nobody knows exactly for how many quarters the impact of demonetisation will last, since it has notably taken a hit on a rural economy relying mostly on cash and has also delayed some investments in other sectors.

The World Bank expects India to grow at 7.6 pc in fiscal year 2018 and 7.8 pc in fiscal year 2019. That is a potential rebound but then the World Bank has made a few prediction mistakes in the past, especially on the medium-term.

Counter effects

Meanwhile, to provide some breathing space to the economy, the government has announced some counter effects measures, notably tax cuts. For instance, tax liability for individuals earning between INR 250,000 and 500,000 (EUR 3,400-6,800) has been reduced to 5 pc from 10 pc.

On the companies’ side, those with an annual turnover of INR 5 million (68,000 Euros) will get a 5 pc reduction in corporate tax.

The overall spending to boost rural economy has also been increased, and the government now aims at doubling farmers’ income by 2022.

That is all very well, but there is no guarantee that the tax cuts and other stimulus measures will be enough to reverse quicker the negative effects of demonetisation. Besides, rural India is still to see how it can improve its purchasing power so drastically, since farmers have been badly hit by the cash crunch, especially in November and December last year. The rural economy relies on cash transactions that account for more than three quarters of the total transactions in many areas.

In this Union Budget, the government is aiming rapidly at a cashless economy, barring, for instance, cash transactions above INR 300,000 (around EUR 4,100) for individuals. But, it is easier said than done, since bancarisation is still to move ahead in many areas.

Changes in terms of Foreign Direct Investments policy

The government intends to facilitate even more Foreign Direct Investments (FDI), which has recorded a double digit growth in the last fiscal year, but it is still modest compared to countries like China, a benchmark Indians like to compare with.

Notably, in an effort of simplification, the Foreign Investment Promotion Board (FIPB), which approves all inbound FDI proposals, will be abolished in 2017-2018. In each case, over 90 pc of FDI proposals are already processed through automatic route.

Then, there is also a big concrete takeaway for foreign investors: they will no longer have to pay taxes on offshore funds with Indian assets.

Uncertainties around the GST

Goods and Service Tax (GST), the much awaited indirect tax for the entire country, which is supposed to make India a more unified common market, is to come into force during this fiscal year. But still, there are uncertainties about its rate (probably around 18-20 pc) and its scope, since the whole matter has to be finalised between the central government and state governments of India. There was no major announcement in Jaitley’s speech regarding this in order to ease business, whereas international investors would have liked some quick clarification since the GST will also have a major impact on India’s new tax architecture and could also have an inflationary effect.

The delicate road to fiscal consolidation

The government is aiming at pursuing its fiscal consolidation, targeting a fiscal deficit of 3.2 pc for 2017-18 and 3 pc for the next fiscal year. This is reassuring for foreign markets and lenders, but they will look at the concrete implementation of the budget.

The Damocles sword of oil prices

India not only depends on internal factors like demonetisation and GST, but also on the international economic atmosphere, which are, in most cases, rather volatile. One of the strong headwinds for India’s economy and budget implementation could be the expected rise in oil prices, in an economy still very dependent on oil imports. This is a Damocles sword hanging above the whole economy, since low oil prices have so far boosted the growth and helped the government in attaining fiscal deficit targets.

The spectre of protectionism

Finally, there are growing fears of a protectionism drive at the world level, especially since the election of Donald Trump as the US president. India would have a lot to lose with protectionist measures taken by the US or other big world economies in form of visa restrictions for its highly-qualified service personnel.

Budget presentations are always reassuring and full of good intentions, but this one came with a lot of uncertainties for the Indian economy, in an international economic environment which could be far less favourable now than during the previous fiscal year.