Parle-G joins job cut spree

The MSME sector considered to be a big employment source that was completely shaken by the twin shocks of demonetisation and GST

The Indian economy’s downward spiral continues unabated as the slowdown encompasses new sectors. Yet, few others than business community, are paying attention, even as the media continues to remain glued to politics.

The country’s largest biscuit maker, Parle Products Pvt Ltd, has joined the rapidly growing list of companies that are laying off workers citing falling demand. The Mumbai-based biscuit and beverages maker says it might lay off up to 10,000 workers as slowing economic growth and falling demand in the rural heartland could cause production cuts, a company executive said on August 21.

A downturn in the Indian economy is shrinking sales of everything, from cars to clothing and thereby forcing companies to curtail production. A sharp drop in Parle’s biscuit sales means the company may have to slash production, which may result in layoffs of 8,000-10,000 people, Mayank Shah, category head at Parle said.

“The situation is so bad, that if the government doesn’t intervene immediately… we may be forced to eliminate these positions,” he said.

Founded in 1929, the company employs about 100,000 people, including direct and contract workers across 10 company-owned facilities and 125 contract manufacturing plants.

Shah said demand for popular Parle biscuit brands such as Parle-G had been worsening since the government rolled out a nationwide goods and services tax (GST) in 2017, which imposed a higher levy on biscuits costing as low as INR 5 a pack. The higher taxes have forced Parle to offer fewer biscuits in each pack, hitting demand from lower-income consumers in rural India, which contributes more than half of Parle’s revenue. In 2003, Parle-G was considered the world’s largest selling biscuit brand.

Parle is not the only food product company to have flagged a slowing demand but the entire FMCG sector is under crisis.

FMCG facing the fall

The fast-moving consumer goods (FMCG) sector is facing a huge crisis as the volume growth has slowed down over the last one year, mainly due to collapse of the rural demand, accounting for nearly 60 pc of the total market for several products and services. Hindustan Lever, a leading company has posted a growth of 5.5 pc in the first quarter this year compared to 12 pc last year, according to a Prabhudas Lilladher report. Various other companies like, Dabur India posted a volume growth of 6 pc during April and June 2019, against 21 pc last year. Britannia too is reportedly showing similar trends as the volume growth was down to 6 pc against 13 pc last year. Emami posted a volume growth of 2 pc, versus the year-ago period’s 16 pc and Asian Paints posted a volume growth of 9 pc in this quarter, compared to the 12 pc of the year-ago period. Given that people seem to be going slow on making everyday purchases, is a worrisome cause for the Indian economy.

Rural demand has been badly hit due to low farm incomes and wage growth. According to Nielsen, the consumer insights firm, the drop in rural growth is mainly due to a slowdown in packaged foods such as atta (flour), refined oil, spices, biscuits, chocolates, breakfast cereals, cheese and sugar substitutes. While there is a slowdown across various food categories in rural areas, the extent of drop is larger in essential (flour and refined oil) and impulse (biscuits and chocolates) food categories. Value growth in these segments has fallen 6.1 pc and 5.6 pc, respectively in the March quarter sequentially.

Varun Berry, managing director of Britannia Industries Ltd, said earlier this month that consumers were “thinking twice” about buying products worth just INR 5. Britannia is Parle’s main competitor in the market.

“Obviously, there is some serious issue in the economy,” added Berry while being on a conference call with analysts.

Nielsen said the FMCG industry this year will grow at least two percentage points slower than in the last quarter of 2018. The projected growth of 11-12 pc for 2019 is a downward revision from its previous forecast of 13-14 pc. It also expects volume growth that peaked at 11 pc in 2018 to come down to 8.5-9.5 pc.

“The FMCG industry has been hard hit by several negative factors such as slowdown in consumption, rise in raw material prices and higher rates under GST. The economic downturn is affecting every sector from autos to clothing,” says Subhasis Roy, deputy director general, Merchants’ Chamber of Commerce & Industry.

Complications in GST

S Rethinavelu, senior president of Madurai-based Tamil Nadu Chamber of Commerce and Industry believes that the government has faulted on the implementation of the Goods and Services Tax (GST) and the FMCG sector has now started to face the implementation muddle.

Explaining the prevailing trade practice in FMCG trade, he said “suppliers in the normal course offer discount to dealers, and at times go that extra mile to help them (dealers) dispose the stock. Such discounts were not subject to tax. However, the clarifications issued by the Central Board of Indirect Taxes and Customs, vide a circular dated June 28, 2019 (two years after the implementation of GST) are ambiguous.

The circular states that if the discount given by the supplier of goods as post-sale incentive to the dealer, then the (special sales drive) discount should be treated as consideration of service (by the supplier). The dealer should raise an invoice on the supplier (for such service), and charge 18 pc GST. “This clarification is beyond imagination. How can the supplier-dealer relationship change as “supplier of service and recipient of service” in the same transaction?” asked Rethinavelu, before continuing “even if a dealer decides to sell at throwaway prices to relinquish his stock, he will have to reconsider his decision, and this incidentally is against the prevailing practice in FMCG trade.

An overall grim situation

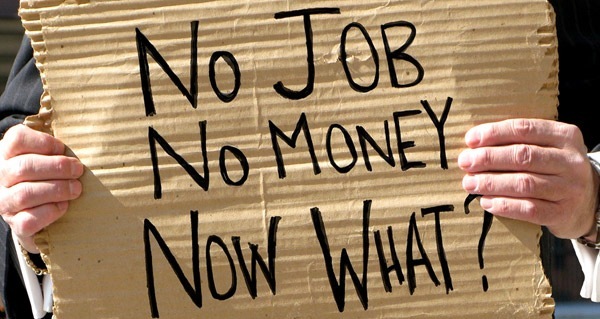

The economic growth of the country has slowed down to 6.8 pc in 2018-19 – the slowest pace since 2014-15. The Periodic Labour Force Survey (PLFS) 2017-18 has found that the all-India unemployment rate is now 6.1 pc, which is an all-time high — highest among male workers since 1977-78, and highest among the female since 1983. Currently, the Centre for Monitoring Indian Economy (CMIE), an economic research organisation, estimates suggest that the unemployment rate stood at 7.5 pc in July 2019. Joblessness has been steadily rising over this period.

It is not just the FMCG sector that is facing the blow of job losses but several industrial and service sectors are facing the crunch too. The only way they are dealing with the crisis is by getting rid of workers as seen in the automobile sector where one million jobs may be lost as automobile sales have slumped, leading to downstream slumps in auto parts makers and various ancillary units. Over 300 dealerships have reportedly shut down.

The MSME sector considered to be a big employment source that was completely shaken by the twin shocks of demonetisation and GST, has slipped further in the recent months. Bank credit data put out by RBI shows that lending to MSME has actually slipped from 0.7 pc in 2018 to 0.6 pc in the first quarter of this fiscal year, signifying that more jobs will be lost in the coming days.

In the real estate sector, unsold inventories stand at 42 months, the normal being 8-12 months. Also bank credit has declined in tourism, hotel and restaurants, IT, transport, real estate and shipping. This is an indication that employment in these sectors is likely to dip.

If the trend continues there will be more retrenchments and layoffs of workers, while contractual workers will simply get dismissed.

Not only are people losing their jobs but the ones who have it are almost getting no appraisal. According to a data from CMIE, appraisals were low everywhere as Indian employers across the board firmly drew a line on their salary outgo.

“The on-going economic slowdown, leading to job losses and fall in income have adversely impacted the ‘impulsive buying’ habit of consumers, with most of them either downgrading their purchases or postponing it all together,” a senior executive of Federation of Indian Chamber of Commerce and Industry, has said.

However, Devangshu Dutta, chief executive, Third Eyesight, a consulting firm focused on the retail and consumer products ecosystem, feels that cuts by companies are not majorly because of decline in demand but due to other external factors as well. “Companies worldwide often make cuts during a slowdown phase, but not always because of a decline in demand; many use the opportunity to tighten up the operations and cut flab, using external environmental factors as a reason,” Dutta told Media India Group.

The Indian government currently is so focused on everything else and the media on the activities of the Indian government that it is forgetting to focus on the crisis of the Indian economy let alone taking necessary steps to revive it. The situation is so pathetic that the Northern India Textile Mills Association (NITMA) had to issue an ad in a national newspaper begging government’s attention. The mast head of the ad read “Indian Spinning Industry Facing Biggest Crisis, Resulting in Huge Job Losses.”

Following this a similar public appeal was issued by the Indian Tea Association that asked the government to ban expansion of tea estates for at least five years and for the Provident Fund (PF) contribution of workers to be taken over by the state government for at least three years, in order to provide relief to the industry.

Such is the situation that when the media is not independently highlighting the crisis, the industry bodies have to take resort to ads to make their voices heard.