HDFC Bank to introduce robot at its Mumbai branch under ‘Project AI’

The HDFC Bank has planned to deploy a robot at one of its Mumbai branches under its project named ‘Project AI’ (Artificial Intelligence) that, acting largely as a receptionist, will greet the customers with options such as cash withdrawal or deposit. Automation of services leads to increased productivity, but in case of a jobs-deprived country like India, it might result in further unemployment.

HDFC bank, an Indian banking and financial services company headquartered in Mumbai, Maharashtra in Western India, has launched ‘Project AI’ (Artificial Intelligence) under which the bank introduced the concept to deploy a robot at its Mumbai branch, the one that does not deal with too many senior citizens who need personalised service. With its name yet to be finalised, the robot will perform minimal duties. The project may be scaled up, depending upon the success of the pilot program.

Basically, in the role of a receptionist, the robot will be at customers’ service, with options such as cash withdrawal or deposit, forex, fixed deposits and demat services displaying on the screen, and will assist further once the customer punches in the selection from the displayed layout of the branch that will appear on the screen with a “Take me there” option.

While the initial plan may look a little basic, the bank plans to include voice recognition and facial recognition technologies and link it to consumer behaviour pattern, reports the Financial Express. Bank of Tokyo-Mitsubishi launched a robot named Nao last year and Mizuho Bank also introduced Pepper to help customers. These ventures are reported to have inspired the HDFC project.

Boost in the market of jobless

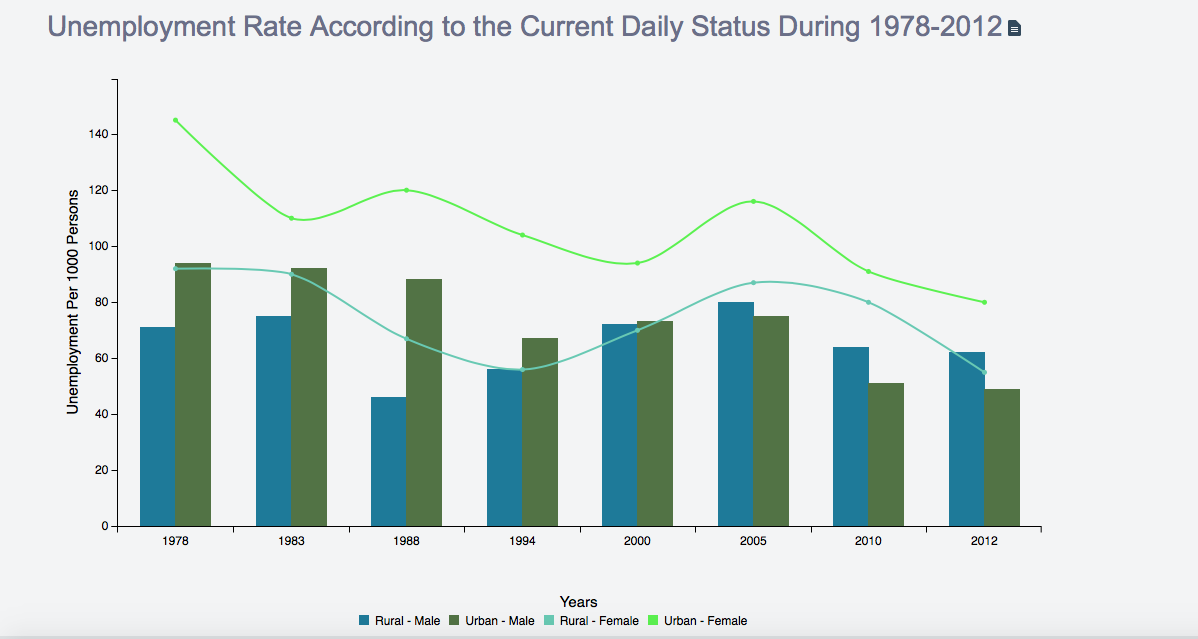

As per the data provided by Open Government Data (OGD) platform, Government of India, in 2012, lowest unemployment per 1000 persons was observed for urban male (49) and highest unemployment per 1000 persons was observed for urban female (80).

According to a report by the CNN, 30% of bank jobs could be lost between 2015 and 2025, mainly due to retail banking automation. Enormous sums of money is being poured into such emerging financial technology and of this, most is focused on making the customer experience better.

In a report published in January by CNN, the World Economic Forum said: “As many as 7.1 million jobs in the world’s richest countries could be lost through redundancy and automation. Those losses would be partially offset by the creation of 2.1 million new opportunities in sectors such as tech, professional services and media.”

Similar effect on Indian economy might further th e consequences of unemployment, like aggravated poverty and increase in social evils like robbery, crime etc. “People with superior qualifications are having jobs which could be done by lesser qualified people, resulting in under-utilisation of one’s capacity,” states National Programme on Technology Enhanced Learning (NPTEL), a program by the IITs , IISc Bangalore and other premier institutions.