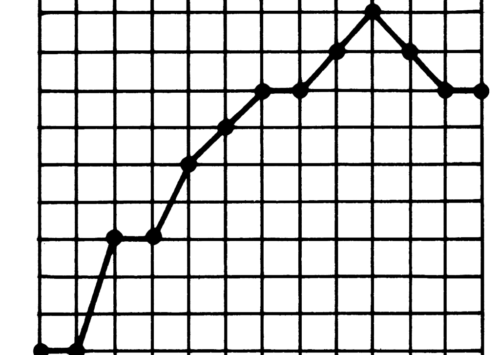

India reports higher GDP despite downbeat speculations

Economists are bewildered as India reports a growth of 7 pc in annual gross domestic product (GDP) during the last quarter of 2016, despite a major cash crackdown.

India retains the position of the fastest growing economy in the world although the period of October-December furbished growth slightly slower than the previous quarter’s 7.4 pc. India’s increase in GDP proved a lot of forecasts faulty, including the Reuters poll of economists that expected demonetisation to have a heavy toll on the country’s GDP, bringing it down to 6.4 pc.

With fresh debates starting to rage on whether the negative reactions by a number of economists were vindictive or if the official GDP data can be qualified as credible, the recent financial overtones in India are attracting interest in the foreign markets as well.

India’s GDP growth was even higher than China 6.8 pc in the last quarter of 2016.

Growth despite demonetisation

While Modi’s decision to make erstwhile INR 500 and INR 1,000 bank notes illegal brought a momentary unrest in the country, there were scholars in the country and abroad who predicted a massive toll on a financial system that mostly used cash. All the economists, who pronounced the move as anarchic and without a vision, are briefly in a state of disbelief.

Distinguished names practicing the science of economics, such as Nobel laureates Amartya Sen and Paul Robin Krugman had criticised Modi’s move in various stern columns. Demonetisation was expected to bring the growing economy in India to a deadlock, causing massive job losses and monumental mislay in the GDP. However, the government, along with the Reserve Bank of India (RBI), maintained their stand, stating the phase as that of ‘momentary hardship’ and also promised a sharp economic turnaround.

OECD Economic Survey

According to the Economic Survey of India 2017, commissioned by the Organisation for Economic Cooperation and Development (OECD), India’s recent annual growth rate of more than 7 pc is the strongest among the G-20 countries.

On February 28, the OECD Economic Survey of India was launched in New Delhi by the OECD Secretary-General, Angel Gurría and Shaktikanta Das, Secretary, Department of Economic Affairs, Ministry of Finance, Government of India. The latest OECD Economic Survey of India 2017 finds that the acceleration of structural reforms and the move towards a rule-based macroeconomic policy framework are sustaining the country’s longstanding rapid economic expansion.

Angel Gurría, in an exclusive interview with MIG, said, “India has started to take bold steps in terms of economic reforms and they have started to bear foot. Even if some of the reforms are yet to start operation, like the GST, they are giving confidence about the future.” Speaking about the growing interest in the foreign markets, Gurría said, “Indian as well as the foreign investors are saying that something is happening in India, let’s go and participate in the future growth of the economy.”

Adding his thoughts on demonetisation, the OECD Secretary General said, “In the long run, demonetisation was a part of a whole process, leading to financial deepening, financial education, instrument the worldwide trend of going cashless, modernisation of Indian economy and also fighting the dark sides of the economy.”

Surprised, shocked or duped?

The government of India rolled out the demonetisation drive on November 8, 2016, when several analysts and economists predicted a sharp fall in India’s GDP growth rate in the last quarter. However, the 7 pc GDP growth has now made a lot of experts eat a humble pie. While many believe that the GDP growth was unnaturally high and there could be a masking being exercised to hide the impact of demonetisation, revision of the final GDP at the end of the fiscal year on March 31 is expected to reveal the right figures.

On Tuesday, an internal study by the State Bank of India (SBI) research team revealed that the GDP figures post demonetisation are ‘too good to be true’. The SBI report outlines the thought that there is more than what the numbers speak on the surface impact of demonetisation if one goes by the expenditure side of demonetisation.

“Interestingly, the impact of valuables on the total estimates from the expenditure side tell the story of demonetisation,” says the research study by the SBI on the impact of demonetisation. Citing instances of steep fall in the international price of gold, partly because Indian demand had momentarily subsided, the SBI report found that there is an imperative need for a more economic investigation into various aspects pertaining to demonetisation.

In a report furbished by Edelweiss, following up the third quarter figures, the company said that the positive surprise could be due to an inventory build-up that took the impact of demonetisation marginally. The consolidated report by Edelweiss said that the agriculture growth increased by 6 pc, government services by 12 pc and manufacturing by 8.3 pc among the most highly contributing sectors. The estimated GDP for the Financial Year 2017 remains unchanged at 7.1 pc year-on-year.

The credibility of India’s GDP data is also under the radar after the unexpected growth figures surfaced. Allegedly, the method of measuring economic activity changed two years back and a sluggish economy suddenly became the world’s fastest-growing major economy. While private economists found it difficult to tally the ground level reality with the superfluous government figures, the recent data has added to the entire chaos. There are examples cited by the RBI survey published this month as well, which shows a sharp drop in customer confidence, including uncertainty in income and employment; however, the government figures show that the economic growth was driven by consumer spending, offsetting a fall in government expenditure.

As we close down to the last few weeks of the current financial year, the reports that are set to make headlines can also be assumed. However, the ambiguity shared astonishment and a latent panic looms large despite international agencies like OECD reporting optimism about the Indian financial sector.