Looking Beyond Airports

AIBM

July - September 2017

Developing the infrastructure in city-side surrounding airports is a lucrative move that has a number of benefits, including financial and economical gains.

Aviation infrastructure is top priority for India, which is currently aiming to become the third largest aviation market in the world by 2020 and the largest by 2030. Hence there is a need to develop airports that are modern and efficient to facilitate easier movement of travellers. This is why the physical infrastructure at airports needs to be as efficient and as productive as possible.

The New Civil Aviation Policy (NCAP), thus appropriately emphasise on Low Cost Carriers (LCCs), modern airports, regional connectivity, etc., which in turn is based on infrastructure development necessary for better connectivity and for enhancing productivity and efficiency.

Infrastructure and Economic Development

The existence of airport infrastructure and associated ground infrastructure is an essential factor in regional development. The presence of infrastructure has a direct relationship on the overall economic functioning of the surrounding area. Airports can be considered to be an infrastructure in itself as it is comprised of runways, taxiways, aprons, terminal buildings, etc.

City-Side Infrastructure Development

Airports Authority of India (AAI) plans to develop city-side infrastructure at 13 regional airports across India through Public-Private Partnership (PPP) for building of hotels, car park and other facilities, thereby boosting its nonaeronautical revenues.

Developing city-side of airports holds significant economic potential for increasing non-aeronautical revenues for AAI. At present, under Section 12, AAI Act, 1994, the airport land can be used only for select activities – however, the amendment to AAI Act under the Union Budget proposes to create an omnibus category that will take care of land use in perpetuity.

AAI has welcomed this move, and is looking to leverage this opportunity to effectively monetise its unused land assets in airports across the country. Currently, the non-aeronautical revenues constitute roughly 24 pc of AAI’s top line, almost half of the global benchmark of about 50 pc, underscoring a need to focus on and develop a vision for land monetisation outside the terminal building. AAI owns more than 55,000 acres of land in and around its airports, and is likely to start the process of monetising about 10 pc of the land owned. The nonaeronautical and other revenues generated through this land monetisation could help in the following areas: Improve the viability of AAI airports; cross-subsiding and rationalising aeronautical charges; make airfare cheaper, thus increasing air traffic; upgrade and develop new airports; and generate incremental Gross Domestic Product (GDP) and employment.

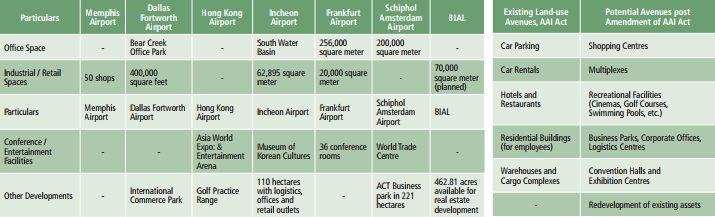

Real Estate Development in International Airport Cities (Table 1), Potential Post Amendment (Table 2)

Avenues of Land Monetisation

Throughout the world, airports are maximizing non-aeronautical revenue sources. Activities related to real estate are the key to these revenue diversification and augmentation strategies – Amsterdam Airport Schiphol in Netherlands, for example, is home to the global headquarters of companies such as ING, SkyTeam and ABN Amro; while Frankfurt Airport in Germany has attracted global players such as DB Schenker in their latest real estate developments around the airport. A comparative analysis for real estate development within the airport city for some of the international airports is presented in Table 1.

Airports are exploring even more creative services beyond real estate developments – Hong Kong International Airport features an IMAX theatre and a 4D extreme screen; and Incheon International Airport in South Korea offers an ice skating rink, a golf course and is developing a 250 acre fashion island.

The amendment to the AAI Act will not only help unlock the potential of the land but will also result in the development of infrastructure on the city-side. Some of the avenues that could be tapped post amendment of the AAI Act are presented in Table 2.

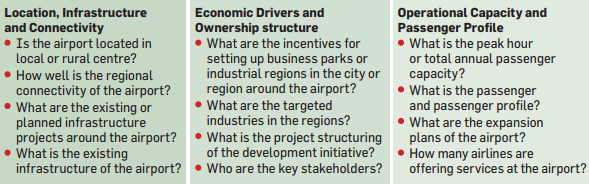

AAI currently manages about 125 airports across the country, out of which about 90 are operational. Effective land monetisation would entail prioritising those airports that offer significant real-estate opportunities beyond the terminal building. The real estate opportunity, however, is not the same everywhere – its attractiveness for investment depends significantly on the city where the airport is located. Additionally, apart from location, factors such as connectivity and infrastructure, regional economy, operational capacity, governance, and real estate demand are crucial for the development of land around the airport. Table 3 provides a framework highlighting some of the key questions that may be employed in selecting the airports suitable for city-side development.

Increased business activities resulting from the infrastructure development of the city-side adjoining the airport will increase employment and income, thereby positively impacting regional development.

In conclusion, the welcome change in the AAI Act will not only open up a window of opportunities for increasing non-aeronautical revenues, but also offers an opportunity to diversify the existing revenue streams beyond the terminal building.