The curious case of new bank notes in India

The new INR 50 and INR 200 notes are rolled out to ease transactions says the Reserve Bank of India (RBI); will it really help the common man of India or is it more of a publicity stunt?

The row of colourful new bank notes continues in India as the RBI rolls out a fresh set of INR 50 and INR 200 currency notes. The RBI released the Annual Report for 2016-17 yesterday where currency management found a separate section. The intro reads, “Currency management during 2016-17 was geared towards managing the process of demonetisation of specified bank notes coming into effect in early November 2016 and the subsequent remonetisation by making available adequate quantity of banknotes to meet the legitimate demand of the public in the shortest possible time.”

The RBI annual report released yesterday under the supervision of Chief General Manager Jose K. Kattoor further states, “As a standard international practice, the design and security features of banknotes are reviewed periodically. In line with this practice, a new series (Mahatma Gandhi New Series) of banknotes in the new design, dimensions and denominations, highlighting the cultural heritage and scientific achievements of the country, was introduced during the year. As part of this process, banknotes in the denominations of INR 500 and INR 2,000 were introduced on November 8, 2016. New design notes in other denominations are due for a phased introduction.”

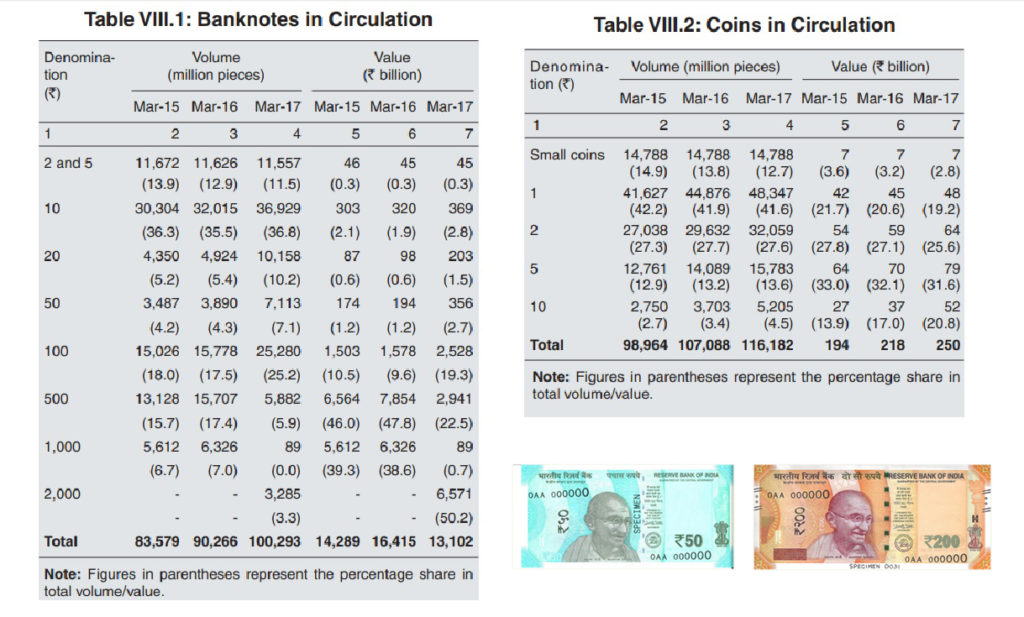

The table shows the number of bank notes and coins in circulation (Source: RBI annual Report); Inset: The new INR 50 and INR 200 notes

Renard series inspires INR 200

The decision of introducing the INR 200 notes was taken by the RBI in March 2017 and the much-awaited announcement was made a couple of days back. The Ministry of Finance announced the introduction of this never-seen-before denomination and said it fills up the missing link between INR 100 and INR 500 notes.

The central bank of a country has the authority to introduce new currency notes based on an assessment of various factors such as the economic performance of the country, the inflation, the need to change soiled/worn out notes and facilitation of transactions.

As the ease of transaction is deemed as one of the major reasons to introduce the INR 200 notes; the reference goes back to a French Army Engineer Colonel Charles Renard who devised a way to help the easiest transactions called Renard series.

The ratio of 1, 2 and 5 used as adjacent denominations also called as ‘preferred number’ series is a geometrically arranged series that helps in breaking the adjacent higher currency in the most suitable means. With the introduction of the INR 200 notes India now has 1, 2, 5, 10, 20, 50, 100, 200, 500 and 2,000 bills with only the INR 1,000 missing.

As the Indian government is presumed to print a set of new INR 1,000 notes to complete 2/3 of the Renard series, the 1-2-5 series also finds usage in international currencies such as EURO and the British Pound.

Here’s a poll on the Twitter profile of RBI Governor Urjit Patel on demonetisation:

What do think of the #demonetisation of notes? #demonetization poll #RBI #Modi

— Urjit Patel RBI News (@UrjitPatelRBI) November 17, 2016

Post demonetisation – Row of new notes

Terming it as remonetisation, the RBI report states, “Keeping in view the urgent need for making available adequate cash to all parts of the country at the shortest possible time, concerted efforts were made by the Reserve Bank and the printing presses to augment the production and supply of bank notes.” While the biggest challenge was to meet the demands, the RBI over the last 10 months has tried to cope up; however, the reports on a failed black money crackdown mission keeps haunting them. The report from RBI further states, “Reflecting these measures, total NiC increased rapidly to INR 15.06 trillion as on June 30, 2017, which was about 85 pc of the NiC as on November 4, 2016. Remonetisation continues to progress at a steady pace with an enhanced focus on printing and distribution to meet the currency demand.”

99.9% of the notes back in the banking system. 100s died in queues. The poor suffered the most. All this for what? https://t.co/cwnfHEGWD1

— Sitaram Yechury (@SitaramYechury) August 30, 2017

Was the crackdown on the black money a successful mission? The Reserve Bank of India figures reveal that 99.9 pc of the old INR 500 and INR 1,000 notes came back after the demonetisation was announced. That clearly suggests the failed attempt to tap the black money in the country. The over estimation of the government was that post demonetisation at least INR 3,000 to 4,000 billion won’t return to the banks as black money owners will be afraid of disclosing their income.

The recent figures released by RBI also talks about the cost incurred due to demonetisation and rolling out new currency notes. The Indian government spent INR 79.65 billion in printing new notes against INR 34.51 billion spent last year. Add to it the cost of establishing new banking systems and logistical expenditures.