The story of smart Indian travellers

India Outbound

March-April 2019

With the steady economic development, women’s financial empowerment, young couples with disposable income and smart technologies, the new age Indian travellers are setting global trends in record numbers. It is not shopping, but relaxation that now tops the agenda when they plan.

Encouraged by its pacesetting seven percent Gross Domestic Product (GDP) growth, India is now the fastest growing outbound travel market in the world, second only to China. The United Nations World Tourism Organisation (UNWTO) estimates that India will account for over 50 million outbound tourists by 2022, making India a USD 45 billion outbound spend market. The growth has been remarkable in the short-haul destinations like South East Asia and West Asia. Within these regions, too, the highest growth has come in the Gulf Cooperation Council countries, notably Dubai.

To put things into perspective, India has been the largest source market for Dubai over the last three years. Overall in 2017, the United Arab Emirates (UAE) received 2.3 million Indian tourists, accounting for 13 pc of all foreign visitors that year and about a sixth more than the tourists from the Kingdom of Saudi Arabia (KSA), the second biggest source market for the UAE.

Rapidly increasing middle class (over 350 million), with growing amount of disposable income is a major catalyst for this outbound travel boom. By 2025, India will rank as world’s youngest country demographically with 65 pc of the total population categorised as Gen X and Gen Y, according to the Census carried out in 2011. Indian tourists are among the world’s highest spenders per visit made abroad. An average Indian traveller spends USD 1,200 per visit compared with the Americans and the British travellers who spend on an average USD 700 and USD 500 respectively, according to the Forbes magazine.

Taking a lesson from the UAE, other GCC nations too have been trying to increase the traffic from India. The number of Indian visitors travelling to the GCC over the coming five years will create the need of an extra 10.8 million room nights, according to Colliers International, an international research organisation. It predicts that around nine million Indians will travel to the GCC by 2022 – 37 pc of India’s total outbound traffic – with mainly business, place of work and leisure behind this demand. Indian outbound tourists stood at nearly 24 million last year.

“Encouraged by increasing middle class incomes, changing attitudes towards spending, group package tours and the easy availability of loans on travel bookings, Indian travellers have emerged as the newest globetrotters in the world. This strong upward trend in growth is also being accentuated by millennials who are reinventing the Indian travel sector. We are clearly seeing a trend where Indian travellers are far more open to experimenting with their choice of destinations,” agrees Sharat Dhall, chief operating officer (B2C), Yatra.com.

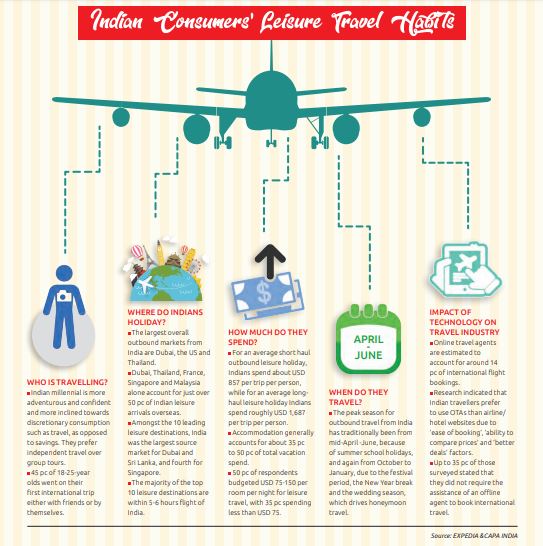

Source: EXPEDIA & CAPA INDIA

A CAPA survey results show that India’s millennials are more adventurous and confident than previous generations when it comes to travel, as well as being more inclined towards discretionary consumption of activities such as travel, as opposed to saving. They prefer independent travel over group tours and are less concerned than their parents about the availability of vegetarian/Indian food, or whether English is widely spoken in the destination.

“The market includes sophisticated segments with an ability and willingness to spend – than most destinations realise. Similarly, there will be large numbers of first-time travellers entering the international holiday market every year. These things point to the need for airlines, tourism boards and travel companies to invest much more in understanding the diverse Indian travel landscape, and to pursue a more segmented approach to product development and marketing in order to grow volumes,” informs Binit Somaia of CAPA India.

A lot of this traffic is headed to the not-so-distant shores of the Gulf Cooperation Council (GCC) nations, notably Dubai, which has become a must-do destination for most Indians. “With a sizeable, young demographic, growing and aspiring middle class, robust domestic economy – India’s outbound travel market is at an interesting tipping point. The improved air connectivity to short-haul destinations and the low-cost carriers make India an attractive outbound travel market. Dubai, Saudi Arabia, Bahrain remain the most popular outbound markets for Indians with increased business & work opportunities, relaxed visa regulations for Indian nationals and an ever-increasing range of leisure attractions in GCC,” says Deep Kalra, founder & CEO, MakeMyTrip.com, a large Online Travel Agency (OTA).

“We have witnessed a 25 pc growth in terms of bookings from Indian travellers in comparison to last year. Some of the preferred destinations are Abu Dhabi, Dubai, Jordan and Oman. Travel for Indians has become a nonnegotiable and the GCC markets offer a truly attractive proposition: being a short haul destination coupled with easy access (across India’s metros, mini metros, as also Tier II and III source markets) and smooth visa facilitation, has been creating a fillip to demand. Dubai and Abu Dhabi’s theme parks and newer attractions like Warner Brothers will only serve to catalyse repeat visits – more so with the child clearly the protagonist of today’s travel story,” says Rajeev Kale, president & country head of Thomas Cook India .

It helps that India is best connected to the GCC with numerous full-service and low cost carriers connecting more than two dozen Indian cities with the GCC. To the UAE alone, there are currently 1,065 weekly flights from India, corresponding to 130,000 seats per week. Meanwhile, aviation authorities on both sides are negotiating an increase in the capacity between India and the GCC.

As Dubai itself targets 20 million annual visitors by 2020, plus an additional five million between October 2020 and April 2021 for Expo 2020 – 70 pc of which will come from outside the UAE – a number of initiatives to increase stop-over tourism have been introduced including new transit visas and dedicated tourism packages. A major chunk from this target is expected from India. “India remains a top priority for us, now consistently being the largest source market for tourists to Dubai. This is a feat achieved through years of establishing and building strong trade ties in the market, in addition to the execution of a segment-specific approach across India,” says Issam Kazim, chief operating officer, Dubai Corporation for Tourism and Commerce Marketing (DCTCM).

The latest India outbound travel market study by Expedia & CAPA India predicts that Dubai will extend its lead as the most visited leisure destination for Indian travellers. It ticks all the boxes given its close proximity and increasing non-stop LCC connectivity from multiple cities in India; wide variety of attractions for all ages; a range of accommodation for different budgets; world-class shopping; high-quality restaurants including easily available Indian food; and a safe environment. Among other destinations in GCC, Abu Dhabi is also doing quite well in similar lines.

Just as Dubai and Abu Dhabi have their own unique sets of visitor attractions from India, the northern emirates are carving stronger identities, supported by their respective tourism authorities. And, while Ras Al Khaimah, Sharjah and Fujairah are smaller than Dubai and Abu Dhabi in terms of supply, they are evolving quickly in getting attention of the Indian outbound tourists. Ras Al Khaimah is working on an unprecedented pipeline, which will more than double the number of hotel rooms, from 4,019 in 2017 to 9,078 in 2021, largest proportionate pipeline in the GCC and very specifically targeting Indian wedding and MICE groups with all the required facilities in place. Ajman is also doing frequent road shows targeting Indian businesses to explore new venture in the media city free zone and around. The number of hotel rooms in Sharjah is also expected to more than double between 2017 and 2021, taking the total number of hotel rooms in the emirate to 5,295 by 2021, again a popular getaway for the Indians visiting Dubai as a package tour.

While the average Indian traveller prefers to stay at the mid-scale hotels, they prioritise spending on experiencing and exploring the key attractions in the destination as well as on good quality food and beverage. Packages curated to these needs will help hotels attract more Indian travellers. Owing to the family and friends centric decision-making culture, Indian tourists typically travel in groups. Offering family friendly amenities and facilities to Indian travelers will attract their attention. Road-shows and aggressive sales calls and lucratively crafted packages directly offered by the hotel brands are keys to attracting this source market. From inducing Indian travel to GCC standpoint, focussed marketing on proper media channels such as radio, television, travel magazines and social media will garner the right kind of attention.

“India is our fourth largest international source market. Our strength is B2B (business to business). We have marketing associations with Cox & Kings, TUI and industry associations like OTOAI (Outbound Tour Operators Association of India). We want to position Ras Al Khaimah as the best compliment to Dubai,” says Shaji Thomas, director – destination tourism development, Ras Al Khaimah Tourism Development Authority (RAKTDA).

Digital travellers

While the traditional media in India remains fairly healthy and has shown growth in advertising revenues, the last five years have seen a dramatic rise of the new media, propelled by the meteoric rise in number of smartphones in India. The total number of internet users, which stood at 432 million in 2016, rose to 465 million in 2017 and is estimated to have crossed the 500 million mark last year. An overwhelming share of these users depend on their smartphones for access to the internet, with mobile devices accounting for 77 pc of internet access in urban India and 92 pc in rural areas.

Social media platforms like Instagram and YouTube have begun playing a key role in the modern traveller’s decision making. An Airbnb survey says that social media played a big role in influencing the Indian travellers while picking accommodation. The survey adds that 47 pc of the respondents cited Wi-Fi as the most important amenity that helps them choose an accommodation and 94 pc of respondents consider social media when booking an accommodation.

Similarly, Indian travelers also rely heavily on Instagram to make their decisions, while picking destinations as in other parts of the world. With more than 500 million users, across the globe, sharing an average of 95 million photos and videos per day, travel plans are continuously being made, shared and made again on Instagram. Today’s frequent travellers browse Instagram 28 days out of every month, searching for new ideas and new holiday destinations, says a latest Arabian Travel Market study. Terry Kane, head of auto, finance, government, telco and travel – MENA, Facebook and Instagram, says, “Today, more and more travellers begin their journey on Instagram, looking for inspiration for their next adventure, next destination to visit or next restaurant to dine in. Viewing the pictures, videos or stories on Instagram gives the users a sense of wanting to be there and wanting to experience what they are viewing.”

Recognising the shift in customers’ decision-making tools, many travel players in India, and around the world, are rapidly adapting new technology to be sure they are not left behind. “Big data, AI & personalisation are having a profound positive impact on the travel industry as it offers customer insights that were hitherto not available. Now, businesses are in a better position to provide customised service, enhance customer satisfaction as well as increase their own operational efficiency and gain competitive advantage. By assembling the right customer experience tools like videos of destinations and multi-lingual voice search, we are actively catering to diverse travel needs and have successfully evolved in becoming a one stop travel shop offering great deals to the customers. By expanding reach extensively in Tier II & III markets, being available to the customers 24×7 and offering virtual tours of destinations, top industry players are trying to reach every potential consumer and develop a mutually beneficial relationship,” explains Sharat Dhall, chief operating officer (B2C), Yatra.com.

Industry experts believe that use of machine learning and AI will help create multi-billion dollar savings as well as helping make the customer experience to become better and more personalised with travel bookings on VR platforms, AI chat-bots guiding customers through the booking process and IoT providing internet based interconnectivity between everyday devices.

“With virtual reality playing an increasing role in attracting patrons towards amusement parks and attractions, integrated photography apps will increase focus on instant gratification. The focus on technology such as facial recognition, artificial Intelligence and augmented reality experiences amongst others will also drive enhancing customer experience. The imaging industry is a factor of tourism and spending patterns by tourists in specific countries. It is an attractive industry with strong growth drivers, its prime focus areas being theme parks, tall towers, aquariums, iconic destinations, and integrated resorts,’’ says Rajeev Kale of Thomas Cook.

The GCC is one of the fastest growing regional hospitality markets on a global scale and an innovative technology-reliant industry. Its impact on hotels and travel and tourism is multi-dimensional, ranging from voice and facial recognition, chat-bots and beacon technology to virtual reality, block-chain and robot concierge.

The use of robots within the hospitality industry is becoming more commonplace with Colliers International predicting the global sale of guest relation robots to reach 66,000 units by 2020, offering a wide range of services such as concierge and butlers who have the ability to deliver luggage, handle check-in and check-outs and deliver meals 24×7 to guests efficiently.

“Travel apps have changed the way people thought about travel – be it planning a multi-city itinerary, hotel stay or activities while one is holidaying or taking cabs. While the planning and booking experience may have changed significantly, there is ever-more than that one needs to do to ensure you keep elevating the experience. In India, people seek a lot more hand-holding than in other parts of the world but we are slowly but surely seeing the shift as more and more people are getting comfortable applying filters to make relevant search, chat-bot conversations to close support loop and more,” explains MakeMyTrip’s Deep Kalra.

‘‘Technology has become a game changer in the travel & tourism industry with regard to ease of travel. By analysing large datasets, these technology-infused travel systems are generating super-personalised suggestions for the travellers in terms of affordable hotel prices, cheap flights and interest-based itineraries. For instance, with the use of technology, hotel booking platforms are minimising the listing commission fee, thus passing on some of the savings to the customers,” explains Ankush Nijhawan, managing director, Nijhawan Group, and co-chairman, travel technology committee, FICCI.

Changing customer habits

In a 2009 survey, CAPA had found that shopping was the number one preferred activity on holiday, followed by sightseeing and experiencing the local culture. In the 2017 survey, shopping fell to the fourth place, while relaxation and rejuvenation bagged the top spot. CAPA says that with the easy availability of foreign goods and brands in Indian markets, notably the new malls, shopping overseas is no longer the unique experience, although it is still popular. Relaxation has climbed as a priority, reflecting evolving societal trends, as busy, working professionals comprise a growing share of travellers, for whom holidays are increasingly about rejuvenation.

“A newly formed changing pattern that is interesting to see is that tourists are interested in slowing down the pace of their holidays. They wish to cram in their choice of adventure and experiential activities instead of visiting 10 countries or five cities in nine days just for the sake of being able to say that they have seen it or done that. Smart personalised technology is helping them to achieve that in a much more independent manner,” says Mahendra Vakharia, president of Outbound Tour Operators Association of India (OTOAI).

This does not signal the end of the frenzied group travels that hop from city to city over a 10-day or two-week period, but it clearly shows the travel industry where the money is shifting. The margins in bespoke travel is not only higher, but will grow rapidly as an increasing number of Indian professionals would tend to take shorter breaks, multiple times a year and would not shirk from spending whatever it takes for them and their families to get that exclusive, customised experience.