Demonetisation: Is the grass greener in MODIfied India?

Biz@India

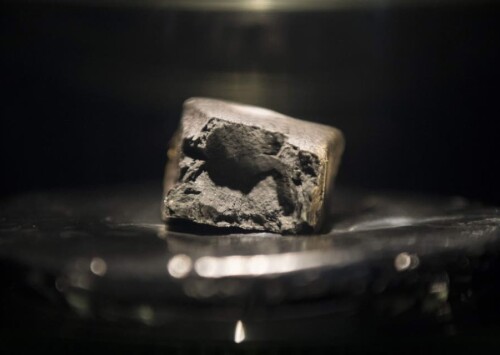

In a national telecast on November 8, Indian Prime Minister Narendra Modi announced the demonetization of INR 1,000 (USD 15) and INR 500 (USD 7.50) currency bills. Ever since, the nation is reeling under the inconvenience. The country, though, remains divided on such a radical move.

Initially Modi won praise from everyone — cabinet colleagues, rank and file in his party, and even the Indian National Congress Party, the political rivals! Corporate India, economic commentators, foreign investors, international think tanks and global rating agencies followed suit hailing the move as a bold and essential one. India’s leading industrial chamber of commerce, Confederation of Indian Industry (CII) described it as a ‘masterstroke’.

The aim behind the government’s action was to combat tax evasion, counterfeiting, corruption and Pakistan-sponsored terrorism.

Finance Minister Arun Jaitley, who is also a well-known legal luminary, defended the move. “The goal of this is to clean transactions, to clean money,” he said.

In 2007, the World Bank estimated the size of India’s shadow economy at 23.2 pc of its GDP. Assuming this ratio still holds, that’s an accounted sum of about USD 479 billion. Much of that money should get mainstreamed because of the demonetisation move.

A report by CRISIL, a global S&P company, observed that “the move could change the face of the Indian economy, improve the government’s fiscal position and tax compliance.” Many more such assessments locally and globally surface to favour the demonetisation move.

Deaths follow demonetisation

Since the announcement, the Indian economy has literally hit the roads. Closely monitoring the situation on an hourly basis, both the Finance Ministry and the Reserve Bank of India are issuing guidelines on exchange of old notes and withdrawal limits.

Meanwhile the centre has formed an inter-ministerial committee to look into concerns expressed by Non-Resident Indians, tourists from abroad and foreign missions over demonetisation.

So far, around 55 commoners and 11 bankers have lost their lives in this cash-starved nation. Some of them reportedly died standing in the long snaking queues. Many others died because hospitals, pharmacies and ambulances refused to offer services in exchange of old notes.

A child reportedly died at a hospital in Noida, owned by union culture and tourism minister, Dr Mahesh Sharma, adjacent to the national capital, after the staff refused to accept old notes for treatment. Several others committed suicide as they had received huge amounts of money against sale of their vast tracts of land. For instance, Kandukuri Vinod, a 55-year-old woman in Mehbubnagar district of Telangana committed suicide after learning that INR 5.5 million ($79,500) that she had got in cash after selling 12 acres of land for the treatment of her ailing husband Vinod, was rendered useless.

Innumerable sordid stories of hundreds and thousands of commoners are surfacing every day. As the poor suffer silently, the government and the ministers are hailing PM Modi as the ‘messiah of the masses’.

Apex court warns of riots

Hearing the petition challenging the ban of high currency notes, the Supreme Court of India has warned the government over possible riots.

Seeking a comprehensive report from the government by November 25, on how they plan to alleviate the sufferings of the common man waiting for hours in queues outside banks for money, Chief Justice TS Thakur warned, “We will have riots on the streets. You have scrapped INR 500 and INR 1,000 bills, but what happened to the INR 100 rupee notes?” He questioned the government about the daily scramble for cash across the country and the punishing queues outside banks and ATMs.

Brickbats galore

On account of continued Parliamentary deadlock, Modi has asked the members of parliament from the Bharatiya Janata Party to fan out to their respective constituencies during the weekend to highlight the ‘benefits’ of demonetisation. He has also asked them to launch an aggressive offensive to counter the opposition’s charges against demonetisation.

It is not just the commoners who are feeling the pinch but even opposition parties are blasting the move.

Former disinvestment minister in the Atal Bihari Vajpayee government, Arun Shourie, wondered why the government had not anticipated the distress that would be caused by “doing away with 85 pc of Indian currency.”

In an interview to a private TV channel, Shourie said, “Jumping in the well is also very radical, committing suicide is also radical… if you want to make a beginning, make a beginning on reforming the tax administration.”

Shourie, a well-known author and former editor-in-chief of Indian Express, who had taken on previous Congress regimes and corporate India, spoke his mind. Others who are still in the government and the ruling party did not enjoy such a luxury. Members of the ruling front point out, in private, how Morarji Desai, the first non-Congress Prime Minister tried to implement a similar strategy in 1978, and was out of power within a year. But that said, Modi has a majority in the Lok Sabha unlike Desai who was running a government with crutches from half a dozen parties.

Members of the ruling party also feel that all may not be over as the Prime Minister has promised. In fact, they fear the Indian economy may crawl for months to come.

Surgical Strikes

Demonetisation has its political angles too. The move was announced just when five states – Uttar Pradesh, Punjab, Manipur, Goa and Uttarakhand – are going to elections in the early part of next year. The stakes are quite high for BJP in Uttar Pradesh and Punjab, where there is a large-scale use of unaccounted money. A bitterly-contested election is in the offing in both Punjab and Uttar Pradesh in February, 2017. The Akhilesh Yadav-led Samajwadi Party is trying to beat anti-incumbency, while the Mayawati-led Bahujan Samaj Party is trying to make a comeback. Though the move to demonetise has badly affected SP and BSP, who have dubbed it as ‘anti-people’ and ‘anti-Dalit’, it has equally affected the prospects of BJP in the state. Leaders from Uttar Pradesh strongly believe the move is a self-goal.

On November 20, Modi is scheduled to address a political rally in Agra where the Taj Mahal, one of the Seven Wonders of the World, is located and visited by millions of tourists every year. Not surprisingly, tourism-related businesses will also be deeply affected, not just in Agra, but elsewhere too. Public-sector bank managers from Agra have sent a report to the RBI Governor that people are outraged with demonetisation. They anticipate an adverse effect on Modi’s rally.

Also, the demonetisation move is becoming a rallying point for opposition parties to establish a united political platform against the Modi government.

Yet, scales are tilted in favour of Modi and BJP. For one, the Congress party has lost much of its steam. Secondly, none of the regional leaders want to be under the umbrella of a single leadership in order to oppose moves like this, as witnessed by the lack of cohesion in the meeting between Delhi Chief Minister, Arvind Kejriwal and West Bengal Chief Minister, Mamata Banerjee.

Aftershocks unabated

Millions of small enterprises in the unorganised sector that use cash to transact will be inconvenienced for a while. Cash-dependent, consumption-led sectors will also feel the pinch, while investment demand will be tempered in the short term.

Unfazed by criticism of the demonetisation move, Finance Minister Arun Jaitley has asserted that replacing 86 pc of the currency in circulation with new bank notes could not have been executed in a better way than is being done now.

But questions are being raised all over. D Thomas Franco, President of the All India State Bank Officers’ Federation, pointed out how RBI was ill-prepared for managing the demonetisation move.

“The RBI office in Chennai gave soiled notes worth half a billion Indian rupees. Soiled notes are those taken out of circulation. Secondly, recalibration of automated teller machines will take 16 days more as the new INR 2,000 notes are of different size. There are 200,000 ATMs in the country. Thirdly, what is the government doing to curb black money as any Indian can remit USD 200,000 every year. This is equivalent to INR 13.5 million. Can’t the government find out where this black money is going?” he asks, calling for the immediate resignation of the RBI governor, Urjit Patel.

Franco pointed out how the bank employees would have to be paid INR 300 billion for working overtime for the next 50 days. This is just a fraction of the cost incurred due to the demonetisation drive.

More actions and reactions are expected in the coming days, weeks and months. Wait and watch this space!