India debates on abolition of old high currency notes

New INR 1000 notes will be introduced soon, announced Union Finance Minister Arun Jaitley

The announcement of vacuum-cleaning 500 and 1000 Rupee bills by Indian Prime Minister Narendra Modi sent ripples across the country; the decision evidently aims to curb black money, corruption, peddling of fake currencies and the sovereignty of India coming under anti-nationalistic threat, according to the ambitious declaration made by the PM in his special address to the nation. However, the announcement has been met with panic, apprehension and cynicism.

While the world was bracing for a riveting Trump-Clinton duel, the emergency speech on Tuesday evening by the Indian PM turned the spotlight towards India. India has always made headlines for being a poor nation with rich people; the recent move is aimed at bringing parity and correcting the imbalance, at least according to the Prime Minister’s Office. Various economists and major thought leaders have substantiated the ill-effect of corruption and black money crippling the country’s potential growth. In a historic announcement last evening, Modi stood by his electoral agendas to take relevant measures to weed out financial corruption in the country by declaring all the old INR 500 and INR 1000 legal tenders invalid. Albeit the primary disapproval from various politicians and a sections of the population, most of the experts tend to argue in favour of this drastic step as a major initiative gratifying his electoral pledge.

`500/1000 legal tender cancellation will end an illegitimate parallel economy & gradually advance India into a cashless economy.

— Arun Jaitley (@arunjaitley) November 9, 2016

Direct Consequences

While rational populace of the country finds it amusing and undemocratic, the argument gains strength as a huge chunk of the black money will supposedly still remain in the condensed form of assets such as gold, forex, real estate and stock market shares. This move is most likely to take a toll on the common people who trade their day-to-day necessities with cash, primarily in rural India.

In a country with almost 75 pc rural population where the economy is mostly driven by cash, this decision comes as a bolt from the blue. Momentary lapse of transaction have set in and small scale businesses along with farmers are found in a state of panic and apprehension.

Over the next few days, the demand of gold and similar investment avenues such as diamonds and silver is expected to soar as it still remains the safe refuge for black money holders in the country. There are mixed opinions on the real estate dealings as well. While some of the experts believe that this will make homes affordable, a few have argued against the step as a radical move that might cripple the very foundation of business until the mist of confusion finds a clearer perspective.

WITHDRAW THIS DRACONIAN DECISION

— Mamata Banerjee (@MamataOfficial) November 8, 2016

Election gimmick or a preparation upset

There are seven states in India that are gearing up for legislative assembly elections in 2017. Goa, Manipur, Punjab, Uttarakhand, Uttar Pradesh, Gujarat and Himachal Pradesh will elect their new governments in the coming year. The demonetisation of high currency notes can arguably be a political gimmick from the Modi government allowing the voters to believe that he has lived up to the expectations endowed in him. Conversely, counter arguments of restraining political activities involving foreign investments and unscrupulous funds are also floating as a major cause for friction and banter.

State elections in the major heartlands of Indian political landscape such as Uttar Pradesh, Gujarat and Punjab knocking on the door, the step of hurried demonetisation is also deemed as a masterstroke to buy the confidence of the voters. However, whether the displeasure among Modi’s industry friends will backfire in this context is yet to be seen.

Am delighted about the demonetising of the notes. Mayawati must be in mourning???

— SUHEL SETH (@suhelseth) November 9, 2016

Foreign tourists jittery

While the government is aiming at long-term goals, the decision is being deemed abrupt and hasty by the international tourists in India. Two French tourists who just landed in New Delhi said, “We just exchanged EUR 300 at the airport this evening and all we got were 500 Rupee notes. We don’t know what to do with them now; it’s an uncomfortable situation for us.” However, when they are informed about the procedures to exchange their currencies at the international airports and banks, there was a momentary sigh of relief. At the same time, it also tends to impose an inconvenience for them to confront an unnecessary hectic drill while their intentions were purely focused on holidaying.

Archaeological Survey of India will accept notes of 500 & 1000 at ticketed monuments till 11th November 2016.

— Dr. Mahesh Sharma (@dr_maheshsharma) November 9, 2016

What will we do with the notes that we have? How will we survive the next few days? Are we going to lose some money? Questions, apprehensions, panic, and a bag full of mixed emotions are crowding the minds. ATMs have witnessed long queues and the social media platforms such as Twitter have started trending hashtags like #SurgicalStrikeOnBlackMoney among similar others. PM Modi in his speech assumed in favour of the common man and said that they should not panic and must cooperate with the government in this mass drive against unscrupulous funds. However, doubts over the long-term goals and the short-term obscurities still remain.

Bold, dynamic & brilliant move to end the black money menace. Beginning of the cashless, paperless economy in India.

— Amitabh Kant (@amitabhk87) November 8, 2016

Modified Indian Currencies – Quick Facts

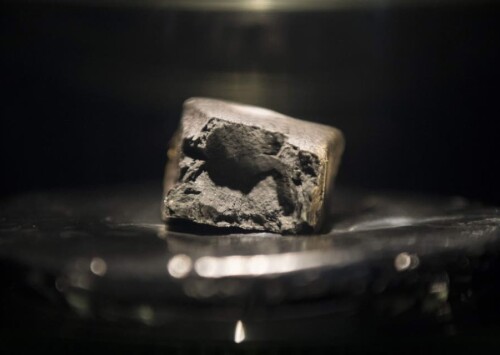

Starting from midnight on November 8, INR 500 and INR 1,000 notes will no longer be a legal means of currency in India. While all other denominations of the Indian currency – 100, 50, 20 and 10 – are still valid, along with all the coins. Cashless transactions, such as cheques, cards and demand drafts, will carry on as usual. All the banks and the ATMs across the country will remain closed on November 9. For the first few days after the ATMs resume service, there will be a withdrawal limit of INR 2,000 per card. This will be raised to INR 4,000 later.

The citizens and tourists have 50 days to exchange the existing INR 500 and INR 1,000 notes at post offices and banks. As of November 10, fresh currency bills of denominations of INR 500 and INR 2,000 will be made available to public for conversion and withdrawal. The notes can be submitted to post offices and banks from November 10 to December 30 by showing a valid identification such as a passport, PAN card or Aadhaar card. Even if you are unable to exchange your notes by December 30, you can still declare them with the Reserve Bank of India till March 31. A cap of INR 20,000 in a week and INR 10,000 in a day is set on the amount of money that can be exchanged. All foreign tourists can exchange their withdrawn notes at international airports.

Modi also announced that the 500 and 1,000 notes will be accepted at some locations till midnight on November 11 in public interest. These places are hospitals, government pharmacies, government bus stations and railway ticket counters, airports, crematoria and burial grounds, milk booths, government-run consumer co-operative stores and petrol, diesel and CNG stations.

Moreover, in order to meet the anticipated heavy demand in the banks, the Reserve Bank of India announced that the banks will be open for transactions on Saturday (November 12) and Sunday (November 13) as regular working days.

Banks to remain open for public on Saturday, November 12 and Sunday, November 13, 2016https://t.co/2Zmd5MLoow

— ReserveBankOfIndia (@RBI) November 9, 2016

Steps against corruption

As the Modi government is around the midway of their term, the abolition of the high currency bills in the country comes as their follow-up steps against black money.

The first step could be traced back to the constitution of a Special Investigation Team (SIT) under the guidance of the Supreme Court in the very first Cabinet meeting. Followed by initiatives such as Jan Dhan Yojana (PMJDY) in August 2014, Income Disclosure Scheme, penalty on real estate transactions undertaken in cash exceeding INR 20,000, prohibition of Benami (unknown) transaction bill, imposition of tax on undisclosed foreign income and assets gave way to the penultimate decision. The recent curb on foreign funds to NGOs falls under the same category of initiatives fighting corruption and black money that arguably sponsor terrorism and other heinous anti-national activities.

Whether these initiatives will at all make a difference to the Indian economy, time will tell – for the time being, the implications are outlined around the strength of character of the apprehensive Indian citizens who are urged to cooperate with the government in this colossal drive.

Here is the latest speech by Union Finance Minister Arun Jaitley addressing the Economic Editor’s Conference in New Delhi for further details…

Addressing the Economic Editors’ Conference 2016 https://t.co/NcDqvKbRNz Nov.10, 2016

— Arun Jaitley (@arunjaitley) November 10, 2016