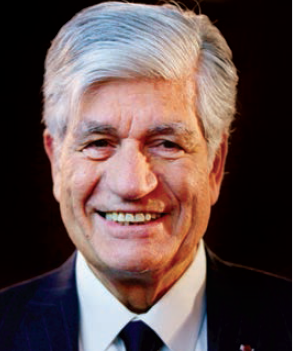

Tom Finke

Biz@India

June 2017

While Asia’s economy is holding up fairly well, the United States of America (US) is likely to continue its slow growth, but barring any surprises, stability is expected in 2017, says Finke.

Being the chairman and chief executive officer (CEO) of a global investment management firm like Barings, puts Tom Finke in a unique position to comprehend and comment on the financial state of the world. He speaks to Biz@India about the economies of various nations, and the future of the market in general.

What’s the feel you get about the global economy? Are people more optimistic than they were earlier, or are they more worried due to things like Brexit?

It’s balanced. There is a fear based on the concerns regarding Brexit and changes in the US political stance on certain issues like trade. But I also think there could potentially be some opportunities for businesses. They may be able to get away from the post-crisis over-regulated business climate and into an environment that encourages the business investment.

Wall Street has been performing very healthily for the last few months, do you think this trend will continue in 2017?

There are different parts to Wall Street and not all performed equally.

There are the transactions, mergers and acquisitions, which in 2016 were okay and not great, but honestly the trading in the fourth quarter was strong. Part of the reason for that was the pop in the markets plus the US elections. Trading on Wall Street is always a cycle depending on the strength and health of the market. Hopefully we see a continuation of positivity in the markets.

How do you expect the US economy to perform this year?

Certainly the baseline has been the lower growth scenario. That has played out for several years now. We really haven’t escaped. I don’t see growth to ramp up significantly. It could increase a little in a positive business environment provided certain issues are cleared up, like tax reform, then maybe people will see potential in the business and subsequently invest in them, and that is growth.

Aren’t you being very pessimistic, because US President Trump has made these statements – that he wants to invest in infrastructure, give tax redemption to companies. Why aren’t you as optimistic?

Because it’s a long way between rhetoric and reality. These things are good. I believe we have to invest in infrastructure. We have to make it easier for US corporations to bring cash back into the country. All those things would lead to enhanced investment and job growth and overall domestic economic growth. That said, there is a lot to get done that will require not just the President saying those things, but the President and the Congress working together to bring the words to fruition.

Globally, if you look at US, Europe and Asia, which region will perform the best this year? Within Asia, is it going to be China, China plus India, or just India?

It’s very hard to say who is going to be the best. Partly because you have to look at their varying starting points. Europe can have a great year if it sees very modest growth especially in the periphery. In China the growth seems to be stabilising, there seems to be maybe less concerns that it is continuing to decline but again there are a lot of expectations from that region. We are constructive on Asia in terms of China stabilising and hopefully there won’t be any big issues in the real estate market. In US, like I said before, we expect at least the continuation of lower growth and hopefully it will increase as the year goes on, if we see positive momentum in business.

As regards India, I am less of an expert on India, not an expert on any economics, I am a trader not an economist. But again, there are positive signs in Indian economy, much like China.

Do you expect the crude to keep rising like it has been in the last few weeks?

If Organisation of the Petroleum Exporting Countries (OPEC) sticks to what it is attempting to do, then yes, or at least I expect it to stay in the trading ranges it’s currently in.

At what level would you start worrying about the oil prices going up?

You have to see a real surge in demand that outstrips the ability to turn back on some of the production that was shut off and that’s been mitigated. What we saw when the prices dropped was the ability of the shale producers to be flexible and shut down production faster than anybody thought. So it would really depend on the technical aspect, I don’t necessarily see it going one way or other unless we get a change in the efforts of OPEC for instance.

In Davos 2016, people didn’t expect Trump to be the President or Brexit to happen, what are the surprises for 2017?

Well, because of the surprises, we are starting to expect the surprise scenario. We saw that with the Italian referendum, a lot of people thought it will go the other way, because that would be the surprise and it went the way people were sort of expecting. I don’t know what the surprise is. It just depends on your opinion

What could go wrong in 2017?

We have to watch out for continuing progress and dialogue in Washington DC and positive momentum there. I was worried about things you can’t control in some ways, for example a terrorist attack that really side-tracks the industry. So there are always things that could go wrong. Hopefully those risks are managed and we have a better year.