The Rise of Asia-Oceania and Middle East

Biz@India

June 2018

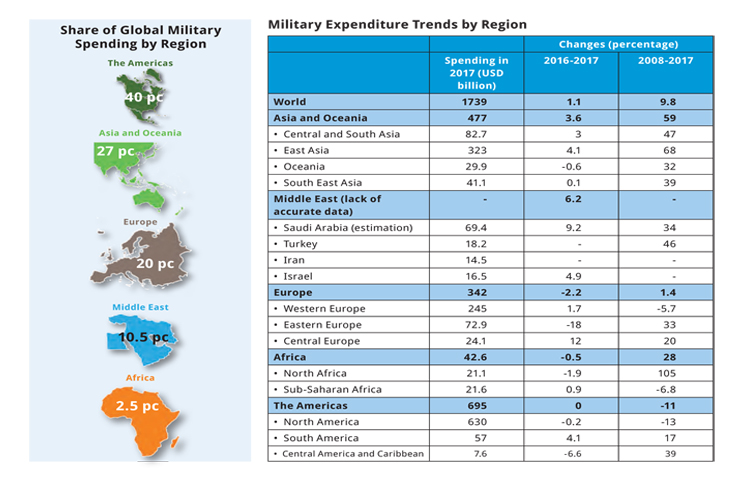

The world has expended USD 1,739 billion in the military segment in 2017, amounting to 2.2 pc of the global GDP according to SIPRI. However, this rise of spending – including all expenditure items – is not uniform and the weight of military spending is shifting away from Euro-Atlantic region towards Asia-Oceania and Middle East regions.

According to the Stockholm International Peace Research Institute (SIPRI), after a stagnation of four years, the continuous trend of growth that the world witnessed for 13 years in military expenditure– between 1999 and 2011 – has resumed in 2017, rising to USD 1,739 billion, amounting to 2.2 pc of global Gross Domestic Product (GDP), which is equivalent to USD 230 per person. It represents a marginal increase of 1.1 pc in real terms in one year and of 9.8 pc in the period 2008- 2017. An upturn, which is mostly due to the continuous increase of Asia-Oceania (during 29 years consecutively) and the Middle East countries’ spending, led by China, India and Saudi Arabia, analyses Nan Tian, researcher with the Arms and Military Expenditure (AMEX) programme of SIPRI.

Military expenditure is a reflection of the power of the foreign policy and the power projection of each country but also of the perception of the level of threats. Those factors, along with the economic conditions can explain the evolution of spending levels in many countries.

Asia, Oceania and Middle East

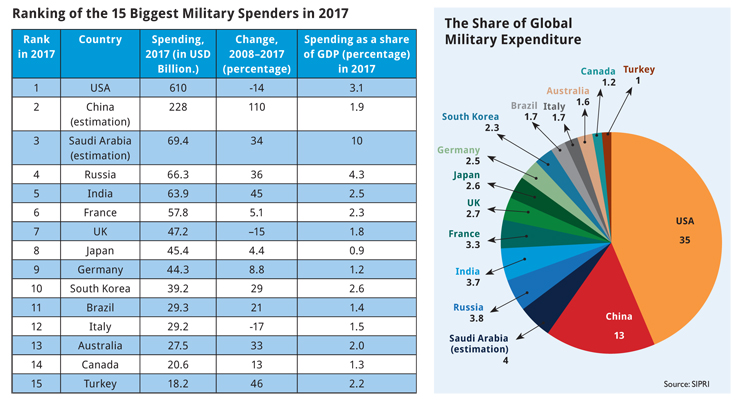

Thus in Asia, the power projection of China, which wants to play the role of a global power, led the country to raise its military expenses by 110 pc from 2008 to 2017. In 2017, China increased this budget by 5.6 pc compared to 2016, reaching around USD 228 billion, according to the SIPRI estimate. It is now representing 13 pc of world’s military expenses.

Additionally, in front of this expansion and of growing tensions and threats in Asia, the countries of the region, especially in east Asia, are increasing their military budget, starting with India – a country that is willing to reinforce and assert its influence in the region and the world. To this end, India has almost doubled its military budget compared to 2008 (45 pc) to reach USD 63.9 billion in 2017. Strengthening of its troops along the Sino-India border after the Doklam stand-off between the armies of the two neighbours, from June till end of August 2017; its focus on the Indo-Pacific zone to counter its rival’s expansionist strategy; and tensions with its other neighbour, Pakistan, illustrate the needs of India for enhancing their military capacities.

With a continuous budget increase since 2008 (a rise of 59 pc), Asia and Oceania, led by east Asia (increase of 68 pc between 2008 and 2017), is the second largest spender by region with a budget of USD 477 billion and a 27 pc global share of military expenditure.

In the Middle East, despite a lack of accurate data for some countries, especially the United Arab Emirates (UAE) – the last estimate from 2014 showed expenses of USD 24.4 billion – Qatar, Yemen and Syria, the SIPRI points out an increase in trend, except a decline of 16 pc between 2015 and 2016 due to the fall in oil prices. The region’s budgets – calculated with the available data – have risen again in 2017, especially in Saudi Arabia with an increase of 9.2 pc, but also in Turkey, Iraq and Iran. Moreover, expenditure in terms of share of GDP in Middle East is 5.2 pc and seven of the 10 countries hold the highest military spending as share of GDP in the world – such as Oman with 12 pc of GDP, Saudi Arabia with 10 pc of GDP and Kuwait with 5.8 pc. The senior researcher with the AMEX programme of SIPRI, Pieter Wezeman analyses: “Despite low oil prices, armed conflict and rivalries throughout the Middle East are driving the rise in military spending in the region.”

Economical Restraints and Roller Coaster Trends

Economic context has prevailed over other considerations in some regions such as Europe, with a general decrease of 2.2 pc in 2017 compared to 2016 and a low increase of 1.4 pc since 2008, notably with the first decrease since 2008 in eastern Europe, driven by Russia. Despite a desire for military modernisation, Russia’s budget has seen, for the first time since 2014, a fall of 20 pc in one year, mainly due to economic problems with economic sanctions imposed by western countries related to the Ukrainian issue. But military spending as a share of GDP is still high at 4.3 pc.

However, Eastern Europe has increased its budget by 33 pc compared to 2008, when western Europe’s budget was decreasing by 5.7 pc in the same period – whereas it rose again by 1.7 pc compared to 2016. But the central Europe’s spending has increased in both periods – by 12 pc in one year and by 20 pc from 2008 – notably because of the perception of threat from Russia. Europe is still one of the largest spending regions with a global share of military expenditure at 20 pc.

Furthermore, the North Atlantic Treaty Organisation’s (NATO) members, mainly European, had to increase their military spending, all together representing (29 countries) 52 pc of global spending with an amount of USD 900 billion – amongst which, seven are ranked in the top 15 of the spenders in the world (US, France, UK, Germany, Italy, Canada and Turkey).

Concerning Africa with a budget of USD 42.6 billion, the SIPRI is noticing a decreasing trend since 2014 with a marginal decrease registered in 2017 (0.5 pc), but overall, between 2008 and 2017, there was an increase of 28 pc, driven by an increase of 105 pc in North Africa, notably due to the largest spender of the region, Algeria. Algeria however, has seen, for the first time since 2003, a decrease of its budget in 2017 of 5.2 pc, reaching USD 10.1 billion, that can be attributed to a decline of oil and gas revenue.

In contrary the sub-Saharan Africa, with spending of an amount of USD 21.6 billion, despite armed conflicts and security issues, has seen a decrease of 6.8 pc between 2008 and 2017, but a rise of 0.9 pc in 2017, especially with the increase of 35 pc of military spending by Sudan. Whereas, the largest spenders of the region, such as Angola, Nigeria and South Africa, have decreased their spending.

Even though the Americas – largely driven by North America, and more precisely by US with its budget of USD 610 billion – has seen stabilisation in 2017, it shows a decrease by 11 pc compared to 2008. The region still represents 40 pc of world military expenditure with USD 695 billion. Central America’s budget decreased between 2006 and 2017 but has increased by 39 pc compared to 2008 to USD 7.6 billion – notably due to Mexico’s economical restraints and the decline of 8.1 pc in one year. South America has registered a rise of 17 pc compared to 2008 and of 4.1 pc compared to 2016, to reach USD 57 billion, mainly driven by Brazil with an increase of 6.3 pc to USD 29.3 billion and Argentina, with an increase of 15 pc to USD 5.7 billion.

India and Saudi Arabia Gains in Global Ranking

Those trends and the shifting away of the weight of military spending from Euro-Atlantic region towards Asia-Oceania and Middle East is reflected in the new global ranking of the largest spenders. In 2017, amongst the 15 largest spenders, accounting for 80 pc of the total world military expenditure with a total of USD 1,396 billion, five countries are from Asia and Oceania: China, India, Japan, South Korea and Australia, and two of them are in the top five. Moreover, amongst the six countries that have registered the highest increase – more than 30 pc – between 2008 and 2017, three are from Asia-Oceania and two are from the Middle East: China, Turkey, India, Saudi Arabia and Australia, resulting in some notable changes in the ranking, notably the upgrade of India and Saudi Arabia. Even if their budget has decreased by 14 pc between 2008 and 2017, it has been stable in 2017 and US remains the world’s largest spender by far, accounting for a third of the world military spending, a budget that is rising again this year.

The budget of China, which still stands on the second rank, was on an increase in 2017 by 5.6 pc. Then Saudi Arabia, with a new increase of its spending of 9.2 pc has overtaken Russia, decreasing its budget by 20 pc, to take its third rank. After Russia, India has taken the fifth rank from France which retrogrades at the sixth position. Indeed, India has increased its spending by 5.5 pc in one year, while France’s military spending has decreased by 1.9 pc. India has implemented a modernisation programmme of its army and almost doubled its budget compared to 2008.

If those figures are giving trends, they should be put in perspective to evaluate armament capacities, since pays and operational cost of the ministry can constitute an important share of costs in some countries such as the US, for which pay and benefits of military personnel and civilian employees are accounting for around 42 pc of its budget.

Towards Further Increase?

Even though India is the world’s largest importer of arms, implementing material modernisation programme and with an important rise of its military budget, these measures are still not enough to mitigate the capacity shortfalls. Indeed, while spending is also important on pay and allowances – around 40 pc according to the Institute for Defence Studies and Analyses – the country is facing large needs for modernisation and renewal of obsolete and ageing defence equipment. Due to its rivalry with China and its Belt and Road Initiative, and the focus on the growing security challenges in the Indo-Pacific region, the government is planning to further invest USD 100 billion in order to enhance the modernisation programme in the three forces. The investment will provide the Indian Navy with helicopters, aircraft and submarines, as announced recently by the defence minister, Nirmala Sitharaman, in response to a report of the Parliamentary Standing Committee on Defence pointing out that the Navy wasn’t benefiting from the budget increase.