GST levy to hinder recovery for budget hotels, says GlobalData

The 12 pc tax implication will harm the recovery of the low-cost hotel sector, that has been reeling under the impact of the pandemic

The decision by the Goods and Services Tax (GST) Council to impose 12 pc tax on small hotels and lodging establishments that charge room rent up to INR 1000 a day has come in for sharp criticism by not only the hospitality industry, but also by major travel industry bodies like Travel Agents Association of India.

It is not just the hotels or the travel agents, even analysts like GlobalData, a data aggregator and analysis firm, have said that the tax will seriously harm the recovery of the low-cost hotel sector, that has been reeling under the impact of the pandemic, which saw their yearly revenues fall by 70 pc in 2020.

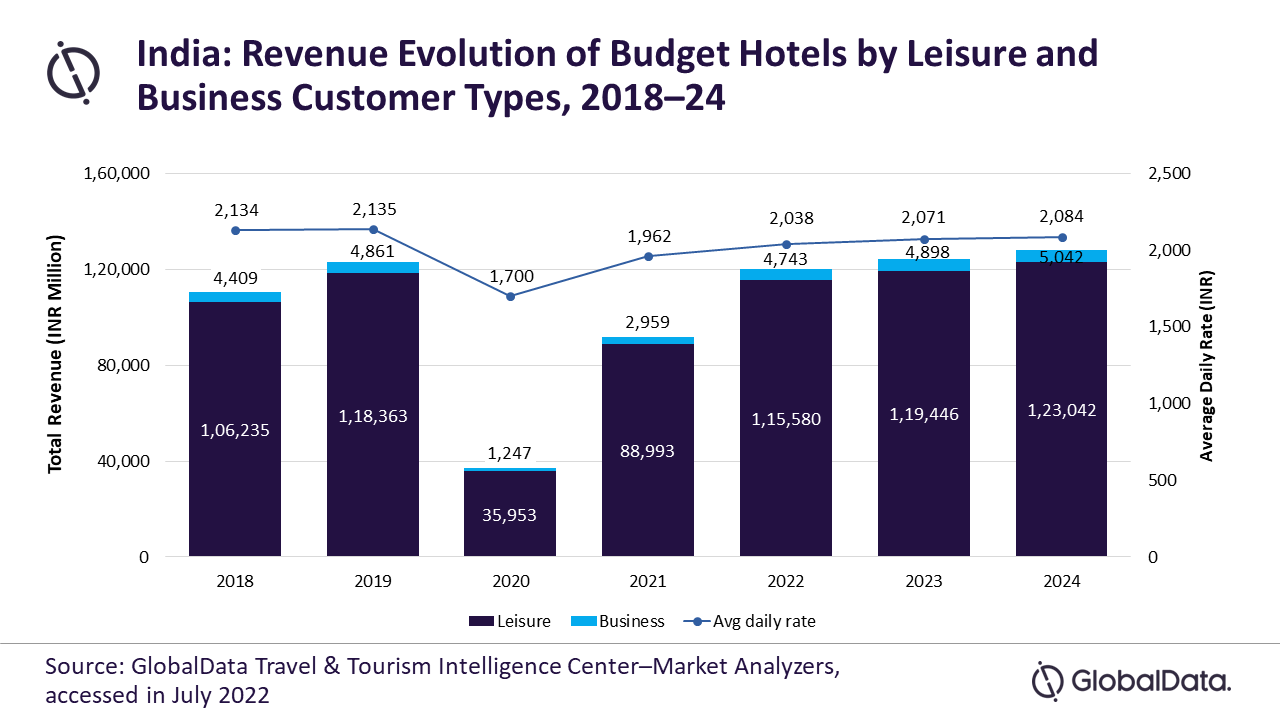

The report says that in 2018, the total revenues of budget hotels in India stood at INR 110.64 billion, with an average daily room rate of INR 2134. The business grew sharply in 2019 to INR 123.20 billion, but average daily room rate stayed flat at INR 2135. In 2020, the business was decimated as revenues collapsed to INR 37.2 billion and average room rent declined to INR 1700.

GlobalData says that in 2021, the sector recovered to reach total revenues of INR 91.95 billion and room rent rose to INR 1962. This year, the sector may see revenues of INR 120.32 billion and room rent climb to INR 2038. The sector is expected to surpass the 2019 revenues only in 2023, when the budget hotels can generate about INR 124.34 billion and average room rent will go to INR 2071, says the report, pointing at the long haul to pre-pandemic scenario that awaits most of the small properties.

This upbeat consumer attitude persisted into 2022, as seen by the fact that 51 pc of Indian respondents to Global Data’s Q2 2022 survey described their travel and lodging expenses as being very high, up from 49 pc of respondents to the Q1 2022 survey.

However, the GST Council’s decision to levy a 12 pc tax on hotels, lodges and clubs with daily room rates of or less may increase overall travel costs for low-budget visitors, who are already dealing with skyrocketing food and fuel prices, says GlobalData. ‘‘Therefore, guest traffic will consequently be diverted to modest hotels that generate less than INR 2 million annually because they are exempt from GST. If there aren’t enough accommodations available, then travelers may be inclined to look for unregulated lodging or even cancel their reservations,’’ says GlobalData.

Furthermore, the increase in accommodation rates will impede the rehabilitation of low-cost hotels, many of which were close to closing permanently at the height of the pandemic. However, as domestic travel increases, the Indian hotel industry as a whole will expand in 2022. After a two-year absence, staycations, pilgrimages, weekend leisure trips and social events are starting to return in daily lives of most Indians.

“The move will deal a heavy blow to India’s budget hotel industry, which saw annual revenues nosedive by 70 pc in 2020 due to COVID-19. However, intensive national vaccination programme and the subsequent easing of Covid-19 restrictions boosted consumer confidence and the hotel industry recovered in 2021. This positive consumer sentiment carried over into 2022, with 51 pc of Indian respondents in GlobalData’s Q2 2022 survey describing their spending on hotels and accommodation as being quite/very high, compared to 49 pc of respondents in the Q1 2022 survey,’’ says Anjali Singh, Consumer Analyst at GlobalData.

Read Also – GST hike to hit tourism industry: TAAI

4 years of GST: Anything but a Good, Simple Tax

GST rates slashed for more than 50 items.

“The revival in domestic tourism has fueled the demand for affordable leisure and homestay accommodations, thereby spurring the recovery of the budget hotels. Consequently, the overall revenue of the Indian budget hotels skyrocketed annually by 147 pc in 2021. The average daily rate of budget hotels also rebounded by 15.4 pc in 2021,’’ she adds.