Jobs, economy yet to recover from twin shocks: AIMO

Most of the popular government schemes like Make In India, Digital India, Skill India and Startup India have not been of much use for traders and micro and small industries, says the survey report

Job loss in the TMSME sector was reported at the rate of 43 pc in the trader segment, 32 pc in the micro segment, 35 pc in the small businesses segment, and 24 pc loss in the medium businesses segment.

According to the results of two separate surveys – one by the Reserve Bank of India (RBI) and another by All India Manufacturers Organisation (AIMO) demonetisation and Goods and Services Tax (GST)- that were expected to be the twin economic reforms has led to job losses, apart from impacting the economy adversely in other ways.

RBI’s latest Consumer Confidence Survey (CCS), published on December 5, indicates that the optimism on employment scenario and economy in general received a jolt right after demonetisation in November 2016 and is yet to recover.

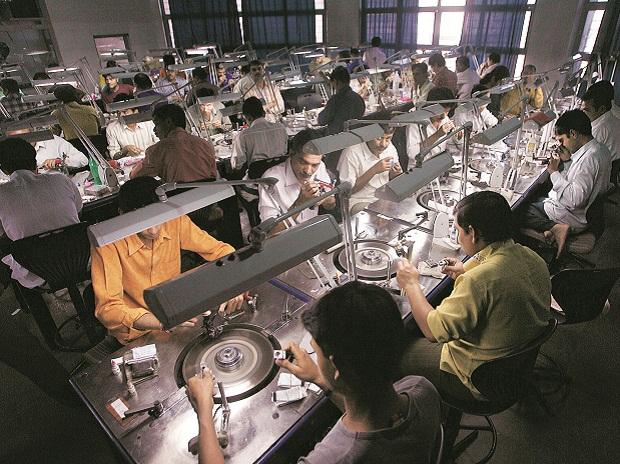

The TMSME (traders, micro, small and medium enterprises) sector has seen a loss of around 3.5 million jobs in the past 4.5 years, according to a survey conducted by the All India Manufacturers Organisation (AIMO). Demonetisation and the goods and services tax (GST) are the main reasons, besides other factors such as e-commerce, according to the survey by AIMO. The TMSME sector has been hit hard, with a job loss of 43 pc in the trader segment, 32 pc in the micro segment, 35 pc in the small businesses segment, and 24 pc loss in the medium businesses segment.

“A large number of people have lost jobs from small and medium companies particularly from the manufacturing sector due to demonetisation and GST. Earlier SMEs used to do transaction more in cash and most of them had no registration with various taxation authorities. Suddenly all large companies started demanding bills with GST, as a result some of them could gradually move up and get the registration and some of them couldn’t,” R P Yadav – chairman & managing director – Genius Consultants Limited, an employment agency in West Bengal, tells Media India Group.

The survey also stated that most of the popular government schemes such as Make In India, Digital India, Skill India and Startup India have not been of much use for traders and micro and small industries, while medium-scale industries feel happier with Digital India initiatives.

“While the current government has taken successful actions in some areas, notably in cutting red tape, India jumped 30 places in the World Banks Ease of doing business rankings to break into the top 100 nations. However, according to reports and economists, manufacturing in India’s economic output has tapered in the wake of demonetisation and the confused launch of GST. I believe unavailability of skills is a major hindrance in creating employment. Whereas, the real challenge is not employment but employability. A single minded approach to increase country’s manufacturing base, might not yield the results. Hence there is a need to align Skill India & Make in India which can create a significant on the industry and economy,” adds Yadav.

Impact of GST and demonetisation

“The current situation index (CSI) declined further in November 2018 in a phase that commenced in November 2016, on the back of growing pessimism on the general economic situation and the employment scenario,” RBI observed in the Consumer Confidence Survey.

“The year 2015-16 saw a growth in all areas of business due to high sentiment and expectations from the new leadership. It went down next year due to demonetisation and then again, due to GST implementation,” the statement from AIMO said. “And then [came the] difficulty in availability of funds and higher outstanding with government payments and compliance matters,” it added.

“Our survey is a clear indicator that the TMSME sector is in a critical condition at this moment and we feel the Government of India needs to address the issue with a lot more seriousness and urgency,” said K. E. Raghunathan, national president, AIMO.

The AIMO has provided a list of suggestions to be implemented to create job opportunities based on the results of the survey. According to the survey, the number of companies making profits now is lower than the number that made profits in 2014-15.

The survey reveals that the number of companies making profit has come down. If 100 companies in the trader segment were making profit in 2014-15, now, only 30 are profitable. In the micro segment, it is 47, in the small segment it is 65 and in the medium segment, the number has dropped to 76. Sectors that need immediate revival and assistance are housing, textiles, automobiles, power, match industries, stone, plastic, tanneries, consumer products, job work units and printing sectors, which employ unorganised labour on a large scale.

“There has been a fall in our business due to the recent buying trends. Due to the wide variety of options available online people are now more comfortable in buying readymade garments than getting it stitched,” says Lokenath Sarkar, the owner of a small tailoring shop in Dhakuria, Kolkata.

Those who participated in the survey, however, credited the present government for being free of corruption, having transparency and pushing online transactions.

Government strategies

Ahead of 2019 general elections, Prime Minister Modi on December 18 indicated that Goods and Services Tax will be reduced from the present 28 pc to 18 pc or to even less on 25-30 items including air conditioners, dishwashers and digital cameras, according to reports. Speaking on the sidelines of the 15th CII Global Business Summit organised by the Ministry of MSME and CII in Delhi, Suresh Prabhu, minister of Commerce & Industry and Civil Aviation in his special inaugural address, highlighted key aspects that could uplift the MSME sector. “We have been working on strategies to build linkages between countries and companies, in essence creating new partnerships of supply chain,” he said.

“The government should make more help desks and impart training for GST as still SMEs are unable to learn and get information about net GST. In one-two years government should do some relaxation on GST regulation on SMEs so that they get some time to cope up,” says R P Yadav. “However, this loss of job is temporary. It’ll definitely recover in coming two-three years. GST and demonetisation will create more job opportunities on employment basis,” he adds.