Time for Indian government to rein in its aggressive tax officials

By appealing the Vodafone ruling in retrospective tax case, the government is prolonging its own misery

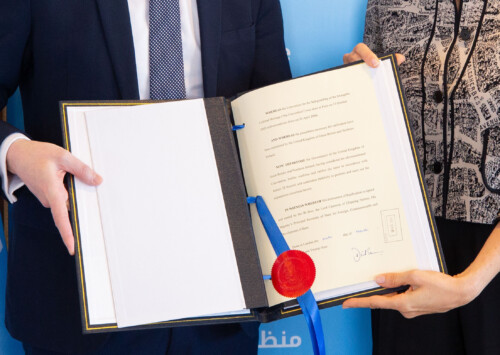

On Wednesday, Permanent Court of Arbitration based in the Netherlands awarded USD 1.2 billion plus costs and interest in damages to the British energy company Cairn Energy Plc in a tax dispute with the Indian government over retrospective application of tax. The case dates back to 2015 when the Indian government handed a bill of USD 2.74 billion applied retrospectively to a reorganisation of the firm in India and creation of Cairn India.

In the dispute with Cairn, the government had seized dividends, tax refunds and shares to partly recover dues after the oil explorer sold a controlling stake in its Indian unit to Anil Agarwal’s Vedanta Group in 2011. The tribunal directed India to repay the money with interest.

Cairn had gone to the court citing the protection granted to foreign investments in India. In view of the fact that investors were invoking bilateral investment treaties to seek remedy for impairment of their assets arising from tax demands, India brought in a new model treaty in 2015 for re-negotiation and terminated all the 73 treaties that existed with other countries.

The Cairn ruling marks India’s second major setback in three months at international tribunals over invoking a controversial 2012 law that allowed the government to claim taxes with retrospective effect. In September, an arbitration court favoured British telecom firm Vodafone in a case dating back to an offshore transaction worth USD 11 billion in 2007 when Vodafone bought Hutchison Essar Ltd. India had put a tax claim of INR 80 billion on the transaction, which Vodafone challenged in Indian Supreme Court saying the deal, transacted outside India, was covered under India’s bilateral tax agreement with the Netherlands.

In 2012 when the Supreme Court ruled in favour of Vodafone, the Indian government modified Income tax laws giving the tax authorities to demand taxes for deals struck before the law was approved in Parliament if the underlying assets in a transaction between two foreign entities were located in India. The Income Tax official then imposed a final tax claim of INR 220 billion on the British firm, adding interest and penalties on the initial demand and in response, Vodafone decided to go in for arbitration.

The government’s loss in both cases in international courts underscores an urgent need for India to put a check on its notorious tax authorities, which seem to have gone totally out of control of late, notably since the imposition of the Goods and Services Tax. As the tax is new and complicated, which everyone from a multi-billion-dollar conglomerate to a small roadside shack selling tobacco products, its hurried and far from perfect rolling out not only disrupted the Indian economy for several months, but also put the challenging task of filing the complicated GST forms frequently and online. Brought in to simplify the Indian tax regime, already infamous all over the world as one of the most complicated and corrupt, the GST has so far only achieved the reverse.

‘Tax terrorism’ continues

Critics remind the current government of the Bharatiya Janata Party that its own Arun Jaitley, who later became the finance minister, had called the retrospective tax act as tax terror by the Congress party. However, even though the BJP has been running the country for the past six years, instead of easing the pressure being put by the tax authorities on tax payers, it has empowered and emboldened them even more, making doing business a huge challenge.

Businesses, big and small, have been complaining that over the past four years, tax officials have been running reckless and abusing rather than using their powers to harass them. Tax terrorism is a common refrain amongst taxpayers in India, today. Last year, thousands of Chartered Accountants in India complained to Prime Minister Narendra Modi about the behaviour of the tax officials asking him to rein in income tax officials “instructed to take all possible actions to plug revenue-shortfall”. The letter was sent jointly by various organisations of CAs in India, notably the Bombay Chartered Accountants’ Society, Chartered Accountants Association Ahmedabad, Chartered Accountants Association Surat, Karnataka State Chartered Accountants’ Association and Lucknow Chartered Accountants’ Society. They alleged that the chief of the central board of direct taxes (CBDT), the apex direct tax body, had issued instructions to all principal chief income tax commissioners (CITs) across the nation to take “all possible action” immediately to boost the collection of direct taxes, including tax recovery.

“Such pressures invariably end up in unreasonable and harsh measures being taken to the detriment of taxpayers. Such a situation would be in sharp contrast to the stated motto of the government of ushering in a taxpayer-friendly regime”, they said in the letter. The letter also said that the government must follow the process of law if at all the recovery measures are to be adopted.

The pressure on businesses right now is even higher due to the economic collapse triggered by the Covid-19 pandemic as the government faces a massive revenue shortfall. Government’s fiscal situation has become precarious since the beginning of the year as the economy is still shrinking. In this scenario, one should not be surprised to see many more aggressive tax officials continuing to hound businesses – honest or not. The government has already filed appeal against Vodafone ruling and expect similar steps against Cairn ruling and may be some more similar cases of retrospective tax claims.