India’s GDP meltdown: Unprecedented but not unforeseen

In a stupor: Finance Minister Nirmala Sitharaman has presided over India’s worst-ever economic performance

The only shock about India’s first quarter GDP numbers is the extent to which the economy has tanked. However, it may not be enough to shake Nirmala Sitharaman out of her stupor.

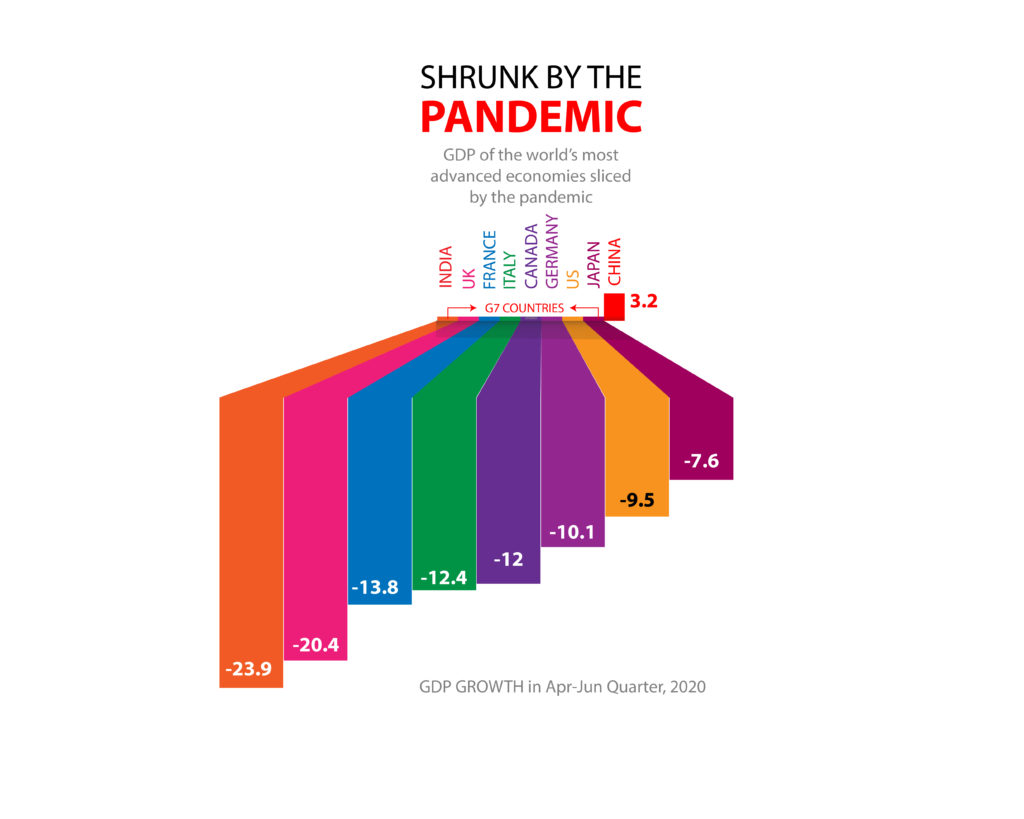

Finally, the cat’s out of the bag. It’s official and on record. The catastrophic drop of 23.9 pc in India’s GDP in the quarter ending June 30, 2020 makes India’s economic performance following the coronavirus pandemic the worst amongst world’s major economies.

The data released by Ministry of Statistics on Monday evening is scary on all fronts. Practically all key sectors have seen a collapse of over 30 pc in output, with construction topping the list at 50.3 pc collapse, manufacturing falling by 39.3 pc and trade by 47 pc. The only sector across board to have shown growth in this period was farming which grew 3.4 pc on the back of a good rainfall, higher sowing for kharif and a record harvest of rabi crops earlier this year.

There was near unanimity amongst analysts that India’s GDP would be shrinking badly in this quarter, but most analysts had pegged a drop of about 19 pc. Not only is the data worse than expected, but it still does not reflect the true state of the economy as GDP calculations are based only on numbers from the formal or organised sector, while ignoring the unorganised or informal sector. The informal sector, spread over tens of millions of tiny firms, employs nearly 80 pc of the country’s workforce. The sector had never really gotten back on its feet after multiple shocks administered to it by clumsy handling of the economy by the government and the resultant mis-steps, starting with the catastrophic move towards demonetisation in November 2016 as well as the rushed and unplanned implementation of GST in August 2017.

The two moves had left Indian economy stuttering well before the pandemic struck, with last fiscal recording growth of merely 4.2 pc, the worst performance in 11 years. Moreover, the highly mediatised witch-hunting of bankers on their credit policies also dried up credit to industry and agriculture alike. A paralysis that continues even today, despite various attempts by the government to revive bank credit. The credit growth has been declining consistently for last four years at least.

Most experts say that even if the formal sector’s contraction is less dramatic in the next quarter, the economy will continue to tank as consumer spending has also reached historic lows and credit offtake is unlikely to have hit a level high enough to at least slow down the rate of deceleration of the economy.

Yet, this is unlikely to shake things around in North Block where finance minister Nirmala Sitharaman has presided over this unprecedented meltdown. Indeed, India’s numbers are of a different level when compared with most large economies. It is only the UK which has seen a GDP contraction of about 20 pc, while all the others range between 13 to 7 pc. Not just that, China, which is where the outbreak began, is back in the black with a growth of over 3.5 pc in the quarter.

The GDP numbers are bound to raise calls for the government to launch a real bailout. Even though in May, Prime Minister Narendra Modi had announced a huge package of INR 200 trillion, it has clearly failed to even stem the tide, let alone bring any economic revival in sight. That could be because a very large part of the ‘package’ was just dressing up of the books. The government is effectively bankrupt as its revenues have been catastrophically dropping or at least a fair distance away from its targets and expenses remain stubbornly high. The deficit is so high that at least on two occasions since last year, the government has forced the Reserve Bank of India to handover cash to balance its books. In August last year, RBI was made to pay INR 17.6 trillion to the government and INR 571 billion earlier this month.

And despite the catastrophic GDP data, the government is unlikely to be able to do much to even provide respite as within four months of FY21 it has reached the fiscal deficit target for the year, meaning it has literally no room to offer any real financial assistance, even though it is precisely that what is needed.

It is perhaps also time for an overhaul of the North Block where Sitharaman has been presiding over moves that have led to this meltdown. The minister seems to be clearly out of her wits and last week blamed the economic misery wrought upon the country as an ‘Act of God’ a statement for which she was immediately jeered and taken down on social media. Sitharaman has been playing an ostrich ever since she was put in charge of the economy. She simply refuses to acknowledge the extent of trouble that the economy is in, pretending that the various slogans being coined and tossed around regularly by the government would do the trick and kickstart the economy.

Now with the extent of the damage done to the economy becoming clear, it may be an opportune moment for Modi to undertake some spring cleaning the finance ministry and bring in heavyweights who would start by seeing and owning up the depth of the economic misery. Only then can India look at an eventual economic recovery.