Pandemic to cloud Indian automobile market despite August uptick

Automobile production in India, as in the factory of Mahindra & Mahindra pictured above, has been declining for over two years now

On Thursday, Society of Indian Automobile Manufacturers (SIAM) said that the passenger vehicle sales in August stood at 215,916 units, a rise of 14 pc as compared to August 2019, ending a 9-month long losing streak that had clouded the mood in the world’s fourth largest automobile market. However, the uptick brought little cheer to the gloomy marketplace. While car sales were up healthily, the three-wheeler sales dropped by 75 pc in the same period and two-wheelers grew only marginally by 3 pc in August 2020.

The last time the market had risen was nine months ago, in October 2019, and that growth itself had followed 11 months of consistent drops in sales. While the downward trend continued in a sustained manner in the first three months of 2020, the market seemed to have crashed into a bottomless pit when the government announced a total lockdown on March 25 in order to combat coronavirus pandemic.

The sustained lockdown and the resultant crash in the economy and tens of millions of job losses brought the market to its knees in fairly quick order. Total production of all vehicles in April-August 2020 fell by over 54 pc to 5.33 million units as against 11.64 million in same period of last year. In sales, while passenger vehicles fell by 49.4 pc, three-wheelers slumped by nearly 85 pc and two-wheelers by 49 pc in the same period.

In this perspective, few are betting that the Indian automobile market has turned the corner on the pandemic and indeed the broader worries about the performance of the Indian economy which has been below par for the past three years or so. Analysts attribute the August growth to the pent up demand that had been building up in the market since the outbreak of the pandemic in India in March. ‘‘Over the past five months, the lockdown badly disrupted the market and led to demand build up. What we have seen in August is partly that demand being released,’’ Gaurav Vangaal, Associate Director of market research firm IHS Markit tells Media India Group.

Vangaal attributes the sales in August to the wholesale market where manufacturers sell directly to large buyers, by-passing the retail market where automobile dealerships come into play. Nikunj Sanghi, managing director at JS Fourwheel Motors and past president of Federation of Automobile Dealers Associations (FADA) agrees that most of the uptick may have come from the wholesale market. He says that most of August and September coincide with an inauspicious period according to the Hindu calendar, resulting in extremely poor consumer-driven sales.

But he has a word of caution for his fellow dealers, some of whom have started buying cars and build up their inventories with the latest models in order to capitalise on the festive season that accounts for a large chunk of retail automobile sales. ‘‘Inventory build-up has already started. There will be sufficient pile up of inventory at the dealer level to look after the festival season. Even if there is a huge rise in sales during the festive season, there is no reason for dealers to worry whether their inventory levels would be enough,’’ Sanghi tells Media India Group, cautioning dealers against buying too much only to end up with dead stock at the end of the festive season.

‘‘The financial health of the dealers is not very good as of now. Because dealerships operate on a low margin of 3-7 pc and as they have not done business for 3-4 months, they will be in no position to have a very positive or a very big balance sheet. So, if the inventory build-up continues the way it is, then there will be stress on the dealerships. Some dealerships might not be able to fund additional inventories,’’ warns Sanghi.

Indeed, the forecast for the automotive sector in the months ahead is anything but rosy. ‘‘The troubles are far from over for the Indian automobile market. Whatever be the demand during the festive season, I expect the industry to close the calendar year, in December, with a drop of about 30 pc year-on-year from 2019,’’ says Vangaal, adding that a view on when exactly the sales will stop declining can only be taken in January.

Sanghi says that the state of the Indian economy does not give confidence about market turning the corner anytime soon. ‘‘There is a trend that whenever there is a de-growth (fall) in GDP, the auto retail numbers go down. All economists and rating agencies are saying that India will experience a fall anywhere from 8-11 pc. So, even if agriculture sector/rural sector does really well, it cannot make up for the loss of business that will happen in the urban sector. In urban areas, businesses have closed, people have lost jobs or faced salary cuts. So, they will not be in a buying mode as most of them are in a cash conserving mode. This year if you look at the whole financial year from April 2020- March 2021, it is going to be a poor year,’’ cautions Sanghi.

Over the past decade or so, Indian automobile companies had managed to build up a small but attractive niche of exports, to offset drops in domestic demand. But IHS Markit’s Vangaal says that in the current scenario even exports are unlikely to come to the rescue of the Indian manufacturers. ‘‘The pandemic is global that has hit economy of most countries around the world significantly, so where exactly can Indian OEMs export to? For the foreseeable future, even that option does not really exist,’’ says Vangaal.

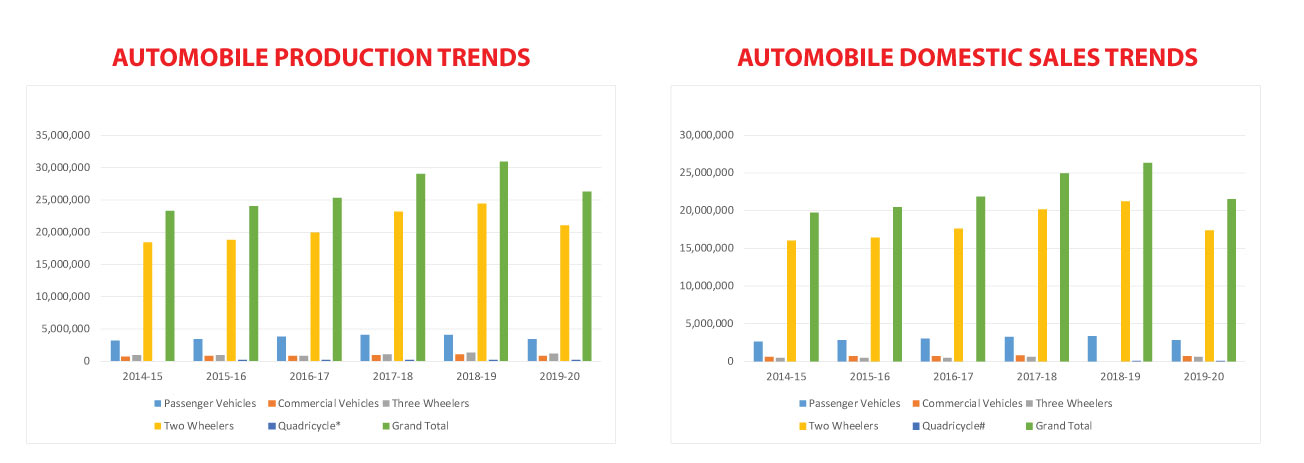

The pandemic definitely has played a big role in the plunge of the automobile market. However, it had been suffering even before. It recorded an impressive jump in production from 23.4 million units in year ending March 31, 2015 to 30.92 million units in year ending March 31, 2019, a hefty growth of 33 pc in four years. However, since then it has been plagued by a series of crises, beginning with a credit squeeze due to collapse of several Non Banking Finance Companies which are a primary source of lending that allow retail buyers to purchase vehicles on mid-term loans, followed by a general economic slowdown that saw GDP growth rates decline sharply from about 8 pc a year to barely 4.2 pc in the year ending March 31, 2020. The automobile market also slumped in tandem with a production of 26.36 million units in year ending March 31, 2020, a contraction of nearly 15 pc in a single year, handing back half the growth of the previous four years.

And as if that were not enough, the scenario has gotten dramatically worse since April 1, 2020 as the production and sales figures indicate. Sanghi says that it would take at least 3 years for the automobile sector to come back to its pre-pandemic levels, signalling that the dealers may be in for a long haul. He cautions that over time manufacturers may indeed push their inventories on to the dealers and this could only expedite many more dealers to shut shop. ‘‘During the lockdown all dealers had shut down. Many may not yet have reopened due to the frequent local lockdowns. ‘‘There is no confirmed report on how many dealers have already shut for good as even now most of the dealerships are closed because of the pandemic and lockdown. So, we don’t even know if they closed permanently or not. However, dealership numbers will go down drastically,’’ warns Sanghi.

Perhaps the only part of the automobile industry that may have bottomed out are the workers. Vangaal says that there are unlikely to be any more job losses than what had already happened. ‘‘The lockdowns meant that most of the skilled workers may have returned back to their villages until the plants restarted. Even now, it is not certain that all workers have returned to work, so the manufacturers are dealing with a fairly serious shortage of skilled manpower. So at this stage it is unlikely that they would fire anymore as the sector faces a huge shortfall,’’ Vangaal says.