With BigBasket, 1mg & CureFit in the bag, Tatas get serious about online shopping

According to a Statista, in 2019, BigBasket was the market leader amongst online groceries in India, with a 35 pc market share (MIG photos)

Better late than never, seems to be the message emanating from Bombay House, the headquarter of the oldest and most diversified Indian conglomerate, the House of Tatas, as it finally ventured into online grocery, one of the fastest growing segments of the Indian economy.

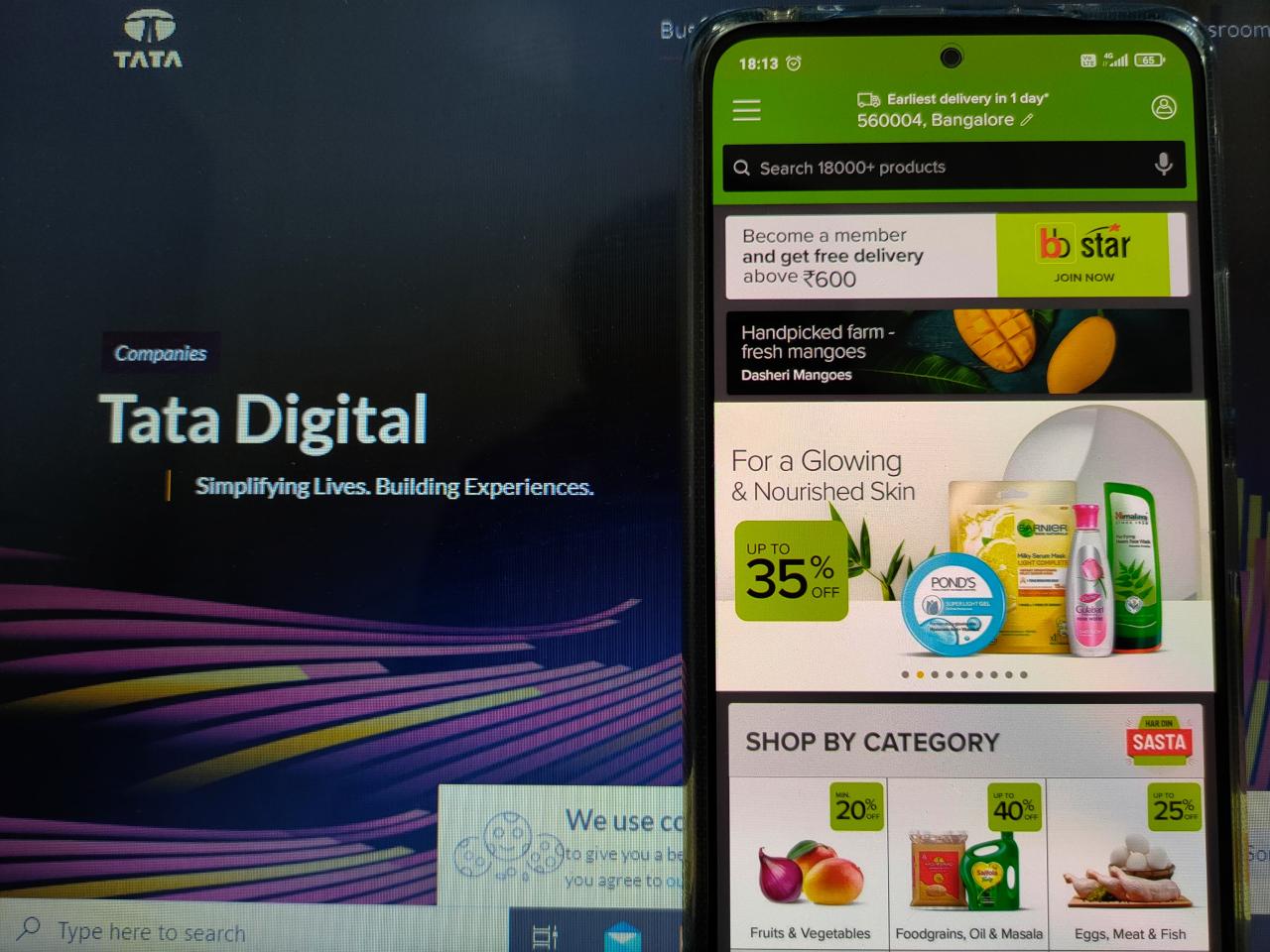

Last week, Tata Digital, a wholly-owned subsidiary of Tata Sons, completed acquisition of BigBasket, for INR 93 billion, to gain a strategic share of the online grocery market in the country. According to a Statista, in 2019, BigBasket was the market leader amongst online groceries in India, with a 35 pc market share. However, two other major players, Amazon and Grofers, also enjoy significant shares.

A RedSeer report in January 2021 valued the Indian grocery sector at USD 850 billion. Groceries account for two-thirds of the total retail spend in the country. Of this, an overwhelming 95 pc share is taken by local mom and pop shops due to their proximity and personalised customer relationships.

Realising that it was late off the mark, the Tata Group is sparing no effort and definitely not money in trying to catch up with the well-entrenched giants already enjoying a lion’s share of the e-commerce market.

Within a week of BigBasket’s acquisition, Tata Digital says it has taken majority stake, of 55 pc, in online pharmacy, 1mg, that competes with market leader PharmEasy in digital healthcare space in India.1mg operates diagnostics labs, has an extensive nationwide supply chain and is a major business-to-business distributor of medicines.

Tata Digital says its investment in 1mg was in line with the giant’s “vision of creating a digital ecosystem which addresses the consumer needs across categories in a unified manner.” Continuing its push into the digital consumer ecosystem, Tata Digital has also acquired CureFit Healthcare, that wants to build India’s largest fitness network. CureFit has a user base of 3 million and its network includes over 5,000 fitness centres spread across top 20 cities in India. The startup with its range of fitness and wellness offerings, will help Tata Digital expand into pro-active health management space, says Tata Group.

Arming for the battle ahead

The sudden hunger in Bombay House for inorganic growth into the e-commerce and digital consumer market in India is unlikely to be satiated with these acquisitions. Tata Sons will surely be on the look-out for completing its armoury, with the idea of having a respectable market share in most of the e-commerce verticals. Only then can it hope to enter the real battle – with other behemoths like Amazon, Reliance Industries and Walmart-backed Flipkart.

Only then the real war would commence for the Tatas, which have been surprisingly late to enter the field, even though they have been market leader in software services through Tata Consultancy Services for several decades. Reliance Industries, too, has been adding more weapons to its collection in preparation of several years of intense competition that lies ahead. Mukesh Ambani’s conglomerate has bought NetMeds, an online pharma firm and is finalising acquisition of MilkBasket, a niche online milk products seller. Both, Reliance and Tatas, have set a goal of transforming their multifarious presence in digital and e-commerce space through super apps, which bring multiple segments onto a single platform that acts as a gateway to consumers, encouraging consistent customer interaction with the platform throughout the day, by offering solutions to their daily needs, says consultancy firm Ernst & Young.

Reliance has been aggressive about its expansion in the retail business – both online and offline. Through its subsidiary, Reliance Retail Ventures, the company has set up 1900 retail stores all over the country. To augment its footprint in the market, RRVL also finalised acquisition of retail business of Future Group, the heavily indebted market leader which announced that it would sell its retail, wholesale, logistics and warehousing businesses to Reliance Retail for USD 3.4 billion.

The acquisition is crucial for Reliance since it would more than double its footprint in the market as the group has over 2000 retail outlets selling groceries, FMCG, fashion and home appliances in over 400 cities and towns across India. Besides the front end, the Future Group also has a wide network of warehouses and logistics, which are crucial for online retail as much as it is for offline.

Besides seeking to reinforce its offline presence, Reliance Industries has also invested billions of dollars in e-commerce through its mobile business, Jio Platforms, that has set up JioMart, to spead head its e-commerce business. Together, RRVL and Jio Platforms have raised around USD 10 billion from investors in 2020 alone in order to be prepared to the battle that lies ahead with Amazon and Walmart.

However, Reliance’s bid to buyout Future Group’s retail business has stalled as it has been challenged in the courts by Amazon which had picked up a stake an unlisted firm of the Future Group and which gave Amazon the first right of refusal in case of Future Group selling out. Claiming that Future was guilty of breach of contract by dumping it in favour of Reliance, Amazon moved the court last year. The see-saw battle has seen several ups and downs for both the suitors of Future Group and now the ball lies in the Supreme Court of India which may take up the case within a few days.

Amazon has so far invested nearly USD 5 billion in Indian e-commerce market place and it has earned a decent market share of about 35 pc, though it continues to be far behind market leader Flipkart, which was bought by Walmart for USD 16.1 billion, three years ago. Amazon’s boss Jeff Bezos has committed to investing over USD 10 billion in the Indian market and as the battle heats up, expect Bezos not to hold his punches back and ply the monies needed to capture the market.

Interesting times ahead for the consumer as the battle in e-commerce space would get much more intense once the Big Four have properly oiled their weapons. With money being no hurdle, trust the e-commerce marketplace to become an ever-more interesting space to watch in the coming months.